“This segment of the M&E sector has an opportunity to keep up its growth momentum, including focusing on selective audience segments, innovative pricing, and diversifying revenue streams,” says the 2024 FICCI-EY report on the media and entertainment sector.

Even though print media is limping back to normal from the pandemic blow, and maybe even seeing some growth, a new report suggests the comeback isn’t complete yet and the medium may stagnate again after the next two to three years. To stay relevant in an era of digital news, print media has to innovate in terms of content, look at other revenue sources, and not be over-dependent on advertising.

According to the report, contrary to the global trend, print media continued to stay alive in India, with advertising revenues growing by 4% in 2023. There was growth in premium ad formats, as print remained a preferred medium for affluent metro and non-metro audiences. Subscription revenues also grew by 3% due to rising cover prices, it claimed.

Advertising revenue was, however, still 14% below pre-Covid-19 levels as the rates remained impacted and had not recovered. Advertising in English publications recovered to 74% of pre-Covid-19 levels while advertising in Hindi and regional language publications recovered to around 93%. It may be mentioned that advertising accounted for 67% of the total print revenue.

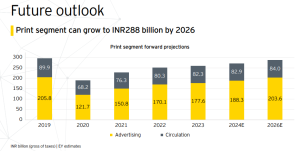

Print revenue, it says, will grow at a CAGR of 3.4% until 2026, when it is expected to reach Rs 28,800 crore, on the back of premium advertising focusing on hard-to-reach affluent audiences, and cover price increases in certain markets. “We expect to see a 25% growth in average newspaper cover prices by 2025. Some products or brands could witness small drops as their faithful audiences age and cover prices continue to increase. As stronger brands survive, multiple products in a household may be rationalized.”

Digital revenues were insignificant for most print companies. There were 456 million digital news consumers in India, of which over 80% consumed news on their mobile phones. Monetization remained a challenge, however, with digital news platforms of newspaper companies generating less than Rs 1,000 crore in ad revenue.

Given that most print companies earn less than 5% of their revenue from digital news products, the focus of print companies will remain on the core print product to increase its utility and appeal to loyal audiences. The digital initiatives of publishers will evolve into a separate enterprise that goes wider than just news, the report suggests.

Word of caution

Despite the growth story, there is a cause for worry. The report says the base of new readers is not growing as fast as it used to, and the second newspaper in a household will disappear from homes. In fact, the need for print media to reinvent itself to stay relevant has been the focus area of most media conferences, reports, and debates in recent times.

CEOs interviewed for the EY-FICCI report said India has started to reach a saturation point, especially in newspaper-reading households, making it challenging to add new subscribers. The report says print players have confirmed that a sizeable portion of their print readers have shifted to their own digital platforms (although this may be more wishful thinking than reality).

On the other end, young audiences entering the workforce have alternative news sources, and, hence, may not subscribe to a newspaper as much as they used to a few years ago. The print segment faces challenges in attracting younger readers, and that can be an existential threat. Continued investment in products (both physical and digital) for young audiences may help build readership.

Reinvention is the need of the hour

The perception of newspapers as the most trusted news source is the biggest differentiator for print publishers, and the segment needs to get together to build the narrative, the report says. The growth of the reader base growth is critical, and increasing the utility of the newspaper can be the answer. This can be achieved in many ways, such as providing more local news, more in-depth analysis, coupons, and discounts on e-commerce sites.

“There is a need to focus on editorial quality by investing in the newsroom to provide unparalleled insight and analysis and perspectives from opinion leaders within the community of readers,” it says. Newspapers can build a stable of high-priced products for niche audiences with exclusive and highly differentiated content.

Alternative revenue streams will get increased focus and revenue from events will contribute to top-line growth, particularly in tier-II and III markets, where national mass brands need greater connect. Newspaper brands could venture into affiliate events businesses and services such as weddings, sports, government events, and ticketing, the report suggests.

Print media could target SME (small and medium enterprises) advertisers that are increasing their spend on media faster than larger advertisers, and build self-serve platforms for these enterprises, aided by generative AI tools to help with content creation.

Other measures suggested include monetization of archives, and exploration of innovative content formats such as short videos, podcasts, and curated short films. The publishers may even consider launching international editions to tap the Indian diaspora and build communities around Indian themes such as yoga, spirituality, and classical music.