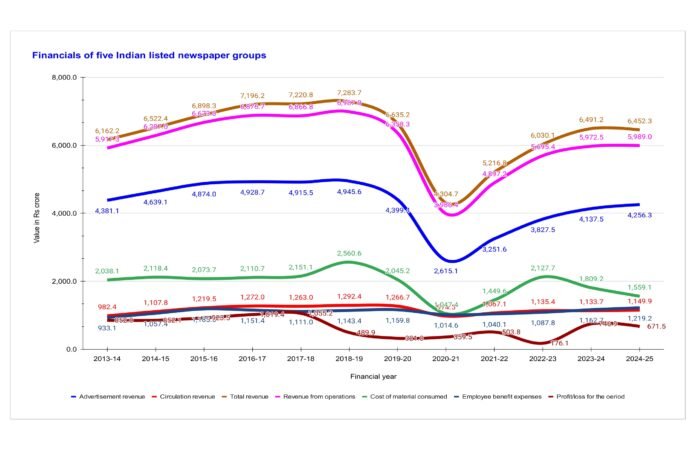

India’s newspaper industry has undergone significant financial shifts over the last 12 years, shaped by rising costs, advertising market fluctuations, and digital disruption. While traditional print media dominated through the mid-2010s, the Covid-19 pandemic in 2020 brought severe economic uncertainty, altering revenue streams and profitability. By analyzing the financial data of DB Corp, Hindustan Media Ventures, HT Media, Jagran Prakashan, and Sandesh, we can observe clear patterns of expansion, decline, and gradual recovery.

Pre-2020: The era of growth and market strength

Between 2013-14 and 2018-19, most of the listed newspaper groups exhibited steady revenue growth, driven primarily by advertising. DB Corp, Jagran Prakashan, and HT Media consistently generated ₹1,000–₹1,500 crore annually in advertisement revenue, peaking in 2018-19. Circulation revenue remained stable, contributing ₹400–₹500 crore annually for larger companies such as DB Corp and Jagran Prakashan. This period marked strong profitability, with firms reporting consistent profit margins despite rising operational costs.

Material costs increased during this time, peaking in 2018-19, which impacted profit margins. However, demand for print media remained relatively resilient, keeping circulation revenues intact. Jagran Prakashan and DB Corp maintained profitability above ₹200 crore, while Sandesh, a smaller player, sustained profits close to ₹60–₹80 crore annually.

2020: The Covid-19 lockdown and industry collapse

The Covid-19 lockdown in India caused one of the sharpest financial crashes for newspapers, as physical circulation came to a near halt. Total revenue nosedived in 2020-21, with advertisement earnings plummeting by over 50% for most companies. For instance, HT Media’s ad revenue shrank from ₹800.7 crore in 2019-20 to ₹349.9 crore in 2020-21, and DB Corp saw a steep decline from ₹1,564.1 crore to ₹1,008.4 crore.

Circulation revenue fell drastically due to restricted movement and digital news adoption, dropping by 30-40% across all companies. DB Corp’s circulation revenue dipped to ₹414 crore in 2020-21, while Hindustan Media Ventures dropped to ₹163.6 crore. The overall financial impact was devastating, with companies struggling to sustain profitability. HT Media recorded a significant loss (-₹81.4 crore), while Jagran Prakashan’s profits shrank to ₹135.5 crore, half of its previous year’s earnings.

Post-pandemic recovery – 2021-22 to 2024-25

By 2021-22, as the economy reopened, advertising revenue rebounded, signalling renewed investment in print media marketing. DB Corp’s ad revenue jumped to ₹1,182.7 crore, and Jagran Prakashan recovered to ₹938.5 crore. However, profit margins remained unstable, as rising raw material costs and shifting consumer habits continued to challenge print circulation.

The financial data for 2023-24 and 2024-25 indicate ongoing stabilization, though not reaching pre-pandemic highs. DB Corp’s total revenue for 2024-25 is ₹2,420.1 crore, slightly below its 2018-19 peak of ₹2,479.3 crore. Similarly, Jagran Prakashan is ₹1,666.6 crore, indicating near-recovery but slower growth.

Despite revenue recovery, profitability remains unpredictable. HT Media continues to report negative results (-₹64.7 crore for 2024-25), while Hindustan Media Ventures struggles with declining profits at ₹77 crore in 2024-25, compared to its ₹193.6 crore peak in 2016-17.

Challenges and future adaptation

While financial recovery is evident, newspapers still face major industry-wide hurdles:

- Digital disruption continues to pressure circulation revenue, requiring companies to expand digital offerings and perhaps mandated revenue sharing with big tech.

- Print production costs remain volatile and could impact profit margins, although newsprint costs have been benign in recent years.

- Ad revenue recovery is slow, as brands prioritize digital advertising including the creator economy over traditional formats.

Looking ahead, DB Corp and Jagran Prakashan seem well-positioned for moderate growth, while HT Media and Hindustan Media Ventures will need stronger financial restructuring to sustain profitability.