As artificial intelligence (AI) becomes a focal point in news media, leading to a revolution of sorts as well as causing disruption as it can be used to spread misinformation – and replace humans – news organizations will look to build unique content and experiences that can’t be easily replicated by the tool, says a new report.

According to Reuters Journalism, media, and technology trends and predictions 2024, authored by Nic Newman, publishers will look forward to curating live news, deep analysis, human experiences that build connection, as well as longer audio and video formats, that might be more defensible than text. Publishers, however, will also focus on using AI tech to make their businesses more efficient in an increasingly difficult economic climate, the report says.

The industry survey was drawn from a strategic sample of more than 300 digital leaders from more than 50 countries and territories. Using AI for back-end news automation (56%) is considered the most important use of the technology by publisher respondents, followed by offering better recommendations (37%) and commercial uses (28%).

Publishers are ambivalent about using AI for content creation, which is considered the biggest reputation risk by over half of respondents as there are deep concerns about trust and about the protection of intellectual property. A number of publications, however, have been experimenting with AI-driven headlines optimized for search, which are then checked by editors, the report says. The respondents attach a very different level of risk to the various uses of AI. Content creation is seen as posing by far the biggest danger (56%), followed by news gathering (28%). By contrast, back-end automation (11%), distribution, and coding are considered lower risk.

In the survey, news executives highlight back-end automation tasks (56%) such as transcription and copyediting as a top priority, followed by recommender systems (37%), the creation of content (28%) with human oversight, and commercial uses (27%). Other potentially important applications include coding (25%), where some publishers say they have seen very large productivity gains, and news gathering (22%) where AI may be used to support investigations or in fact-checking and verification.

Future of journalism

Forty-seven percent editors, CEOs, and digital executives say they are confident about the prospects for journalism in the year ahead. One-tenth (12%), however, expressed low confidence. Concerns include rising costs, declining advertising revenue, and a slowing in subscription growth – as well as increasing legal and physical harassment, the survey said.

The Reuters report foresees even more newspapers stopping daily print production this year as print costs rise and distribution networks weaken or in some cases reach breaking point. It says there will be a shift towards bundling of digital news and non-news content as large publishers look to lock in existing customers.

All access subscriptions will include games, podcasts, magazines, books, and even content from other publishers. Publishers also plan to create more videos, more newsletters, and more podcasts, but broadly the same number of news articles – as they look to hook more audiences and advertisers.

Focus on direct traffic

As referral traffic from social media sites fall, publishers will focus more on their own direct channels in the next year and package and distribute content in a way that makes journalism more relevant for different audiences. According to the report, two-thirds (63%) of respondents were worried about the decline in referral traffic. Chartbeat shows traffic to news sites from Facebook fell 48% in 2023, with traffic from X/Twitter declining by 27%.

Keeping this in mind, 77% of publishers say they will focus more on their own direct channels, with a fifth (22%) resorting to cutting costs and a similar proportion (20%) experimenting with alternative third-party platforms, the report says.

New social media channels

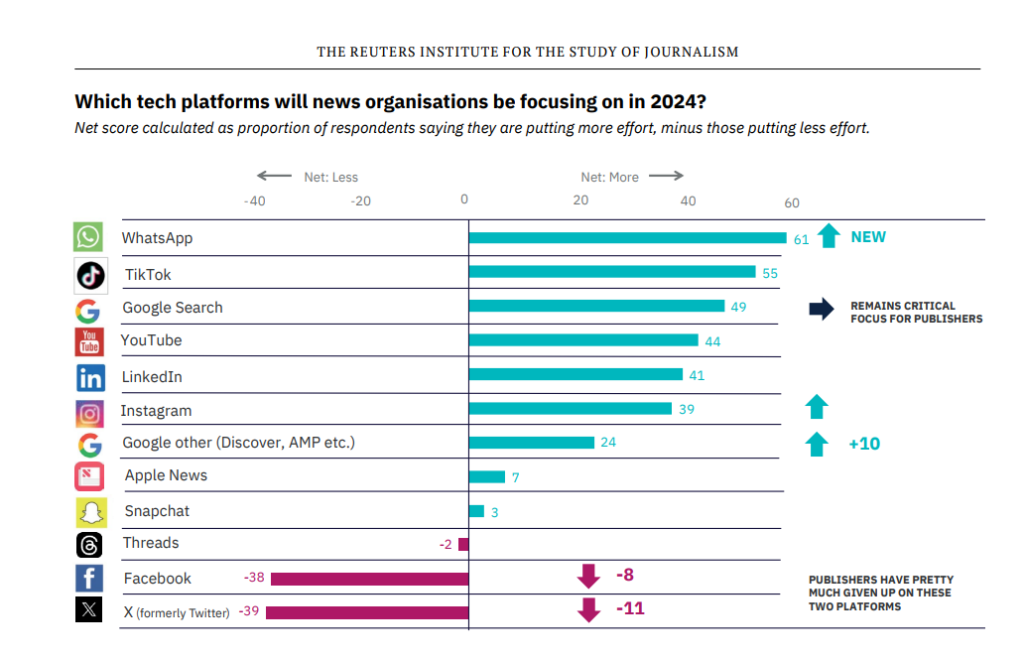

Publishers are expected to focus more on direct channels such as WhatsApp and Instagram following Meta’s decision to open up broadcast channels for publishers, the report says. WhatsApp channels that appear in the Updates section of the messaging app are being pushed by publishers. Users can follow or subscribe to a brand, react to posts using emojis, and forward them into private chats but there will be no open commenting. Telegram channels are another similar emerging tool being used by publishers to reach out to a wider audience.

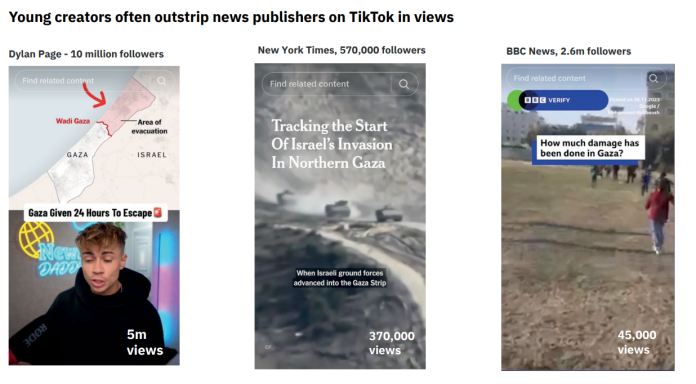

Interest in video networks such as TikTok and YouTube, the report says, remains strong while Google Discover is becoming a more important source. Publisher sentiment toward Facebook and X/Twitter has worsened further this year.

News avoidance a worry

One major cause for concern is selective news avoidance and news fatigue. To counter this, publishers look to better explain complex stories (67%), more solutions-oriented or constructive approaches to storytelling (44%), and more inspirational human stories (43%). There was less support for commissioning more positive (21%) or entertaining (18%) news.

“News avoidance is on the rise in Switzerland, which we need to counter with new journalistic approaches, topics and formats,” Newman quotes Marc Isler, Chief Revenue officer, Tamedia, as saying. In fact, news avoidance was a major point raised at various media seminars organized by media associations such as INMA and Wan-Ifra across India and the world.

Subscription and membership

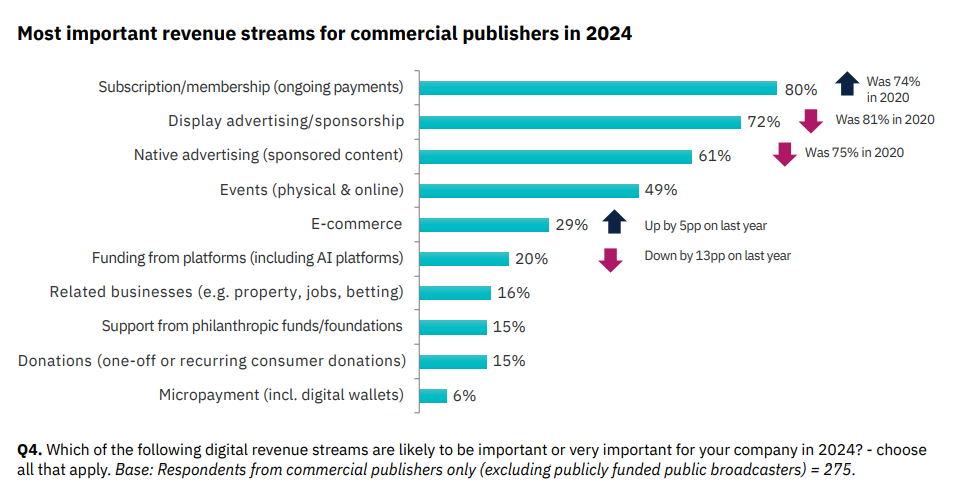

To garner more revenue, publishers will continue to invest in subscription and membership, which will overtake ahead of both display and native advertising. Eighty percent of those surveyed said subscription and membership will be an important revenue stream. Most operating a paid model reported a slight increase or stable subscription numbers in the last year.

Experimental interfaces to the internet such as AR and VR glasses, lapel pins, and other wearable devices will be a feature of the year ahead. But existing voice-activated devices such as headphones and smart speakers, as they get upgraded with AI technologies, are considered by respondents to be the most likely option (41%) to displace – or at least supplement – the smartphone in the medium term, the report said.