Industry experts tell us that the demand growth for consumer products, and hence both flexible and board packaging, softened in Q1 of FY 23-24. With rural demand particularly depressed, the periodic ups and downs seem systemic and point to single-digit growth in demand. The research data thus far on a leading group of food-related FMCG companies reveals expectations of flat or soft growth for most of the bigger companies, except Britannia and ITC’s food consumer products division. Mrs. Bector’s Foods and Jyothi Laboratories are the smaller companies, also expected to achieve higher growth in the coming quarters.

Nevertheless several of the larger packaging companies continue to invest in capacity expansion. Among the global actors in India, SIG Combibloc continues to rapidly increase investments in India with the recent opening of its bag-in-box plant in Palghar and the commencement of construction in its Ahmedabad aseptic packaging plant. Hutahmaki India has a new project, which is banking on solutions for sustainable monomaterial flexible packaging with a new W&H blown film line with MDO and a Bobst vacuum metallizer. The Indian-owned SB Packaging, apart from absorbing Constantia’s Indian assets across the country that it acquired, has also ordered significant capital equipment for its main plant in Hissar.

In mid-August comes the news that global packaging giant Amcor which is headquartered in Australia, has acquired Phoenix Flexibles in Gujarat – a business said to generate an annual revenue of approximately US $20 million (Rs 165 crore) from the sale of flexible packaging for food, home care and personal care applications. The acquisition is subject to customary closing procedures and is expected to close in the September 2023 quarter.

Amcor already has four flexible packaging plants in India that it says delivered double-digit organic sales growth annually in the last three years. It says it has significantly outpaced growth in the underlying market, and is investing to double its local footprint in the pharmaceutical and medical packaging segments.

Amcor Flexibles Asia-Pacific president Mike Cash said, “Amcor continues to see substantial opportunities to grow our flexible packaging business in India. With this acquisition, we are investing to maintain and build upon the significant momentum the business has delivered over several years. The scalable nature of the acquired facility, combined with the localization of new capabilities, further enhances our customer value proposition in this attractive high-growth market.”

Uflex results

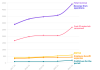

Uflex, the Noida-headquartered global flexible and aseptic packaging conglomerate, which is continuously adding new plants and capacity, has reported a total consolidated revenue for the financial year ending 31 March 2023 at Rs 14,662 crore, an increase of 11.7 % from the previous year’s Rs 13,127 crore. The consolidated net profit after taxes has declined by 56% to Rs 480 crore in comparison to the previous year’s Rs 1,099 crore. On 27 July the stock is quoted at around Rs 419, down from Rs 555 a year ago – and its peak of Rs 804 on 26 August 2022. Its share price was Rs 265.50 a share on 27 July 2020. Approximately 45% of the shares reside with the promoters, while approximately 47% are owned by the public.

Monocartons

The larger and medium-sized monocarton companies such as Parksons, TCPL, CanPack, Kumar Printers, ITC Packaging, Pragati Offset, HBD, Suki, Bhudhraja, Any Graphics and White Print O Pac, VK Global, Sain Packaging, York Printers and Galaxy Offset have in the main been building new plants and adding printing and converting capacity. Among the larger carton companies, faster and more automated presses and systems are replacing their earlier 6 and 7-color plus coater UV presses to remain competitive at a time of single-digit demand growth for the overall market.

For their part, the commercial printers migrating into monocartons have understood that to be competitive in this segment, efficiencies in inputs and resources are easier to achieve on larger format presses. Having entered monocartons and litho-laminated cartons with multicolor presses in smaller formats, they are now graduating to the second stage of their diversification by installing larger format machines with coaters and UV curing. In some cases, these can even be reasonably modern used presses.

In the past half-year, the carton industry has also taken a hit from one of the major alcobev suppliers doing away with the outer carton packaging for their liquor bottles. This measure has taken an unquantified but substantial tonnage out of the carton industry and instilled the fear that other liquor manufacturers may be thinking along similar lines.

Narendra Paruchuri of Pragati in Hyderabad, who is generally measured in his condition monitoring of the industry, says that at least high-end commercial printing is keeping its head above water, although not as strong as monocartons. From his point of view, the seasonal upswing for cartons also looks promising.

Meanwhile Pragati has just installed another new multicolor press, highly configured for the special coating effects for which it is known. This is a Komori GL 40 full UV 7-color press with two coaters, one coater after the sixth printing unit and another coater after the seventh printing unit. This enables a full gamut of print and drip off and gloss coatings on first six units and the first coater followed by the seventh print unit that can either add an overprinted color or an overprint varnish and then a coater for matt coatings. Thus, it becomes possible to ad textures, gloss and matt coatings in a single pass.

TCPL adds both flexible and carton capacity in FY23-24

One of the several companies that are in both monocartons and flexible packaging, TCPL Packaging, continues to diversify and grow in the current financial year which started out with high expectations of the Indian consumer economy picking up steam. Its third Bobst gravure press, a Rotomec 8-color, is expected later this year. Meanwhile, one highly configured KBA multicolor sheetfed presses has been installed in Silvassa and a second is to be soon installed in Haridwar. Another sheetfed multicolor press, a Komori GL40 6-color plus coater UV press, is to be installed later in the last quarter of the calendar year at the Creative carton plant in Noida that was acquired a couple of years ago by TCPL.

TCPL’s results for the financial year ending 31 March 2023 show a healthy 35.8% rise in revenue to Rs 1,474 crore from Rs 1,085 crore in the previous year. Profits have increased to Rs 111 crore from Rs 47.35 crore in the previous financial year, representing an increase of 136%. The company has also announced the doubling of its dividend to Rs 20 per share on its Rs 10 face value shares that are currently being quoted at around Rs 1700 – an increase of about 70% since last July. Three years ago on 27 July 2020, TCPL Packaging shares were selling for Rs 277 each on the National Stock Exchange. While the company is majority owned by the promoter family, around 39% of the shares are in public hands.

(This article has been updated on 18 August 2023 by the author to include Amcor’s acquisition of Phoenix in Gujarat. It has again been corrected on 22 August 2023 by the author to correct a couple of factual errors about press installations and configurations.)