CMYK+ embellishments are competing against headwinds resulting from limited market awareness, pandemic-driven cost cuts, and an inflationary market environment. As a result, print service providers (PSPs) want to leverage CMYK+ embellishments to focus on ways to promote these services and educate their clientele.

Printing embellishments, commonly called ‘CMYK+’ convey a sense of quality and support a message of value and excellence. Consumers of printed materials recognize that there is more to a printed page than simple monochrome or process color output.

CMYK+ Printing Embellishments

The ability to print more than just the CMYK process colors (cyan, magenta, yellow, and black) is a common feature of offset presses, which often have a fifth or sixth unit for printing special effects like Pantone colors, metallic inks, and neon or fluorescent colors. In wide format digital printing, colors beyond CMYK are common, with many devices supporting eight or twelve colors. In the production digital print market for documents, however, there are a relatively small number of exceptions to four-color devices.

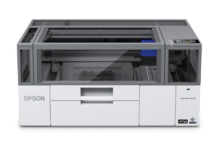

Systems supporting more than four colors (what is frequently referred to as CMYK plus or CMYK+) have been around since as early as the 1990s in devices from HP Indigo, Kodak NexPress, and Xeikon. In the past decade, CMYK+ capabilities have expanded to a much wider range of digital print devices by many system vendors. These most frequently offer a fifth color for effects like clear coatings, white, and special colors. These extra colors/effects, which may also be referred to as CMYK+ printing embellishments, are applied in-line with CMYK. In addition, there are offline devices that use digital print techniques to add special effects like spot coatings, dimensional effects, and metallic foils.

Market for CMYK+ Embellishments

In a research conducted in 2016, Keypoint Intelligence (formerly InfoTrends) predicted that the digital print enhancement market (in other words, CMYK+ pages produced via digital print) would expand at double-digit rates through 2020. Despite this healthy growth, digital was still expected to represent less than 2% of the available enhancement market, most of which would continue to be produced with traditional methods like offset lithography.

The drivers behind this growth were expected to be continued introductions of in-line and offline systems as well as the expansion of colors and effects for existing systems. A declining cost per page for digital enhancements, combined with the perceived high value of these effects, was also expected to contribute to growth. While some of this has indeed occurred, the industry has seen significant pushback from PSPs who are struggling with perceived customer indifference.

Another research from Keypoint Intelligence states, print buyers in the US and Western Europe were asked about the importance of key factors related to print enhancements when buying or designing print. Top among those factors was print quality, followed by drawing attention, enhancing the brand, and differentiation. At the other end of the scale, protecting the piece from damage and security issues like preventing counterfeiting came in relatively low. Security features like an IR or UV inks that prevent counterfeiting would be highly valuable for customers that are producing certificates, coupons, or tickets, but of less interest for other applications.