Drupa retains the support of a string spread of the industry, but the loss of three more digital press providers will continue speculation about next year’s show, writes Gareth Ward of Print Business www.printbusiness.co.uk.

With less than 190 days until Drupa is due to open its doors in Düsseldorf, the exhibition suffered the loss of three Japanese exhibitors last week.

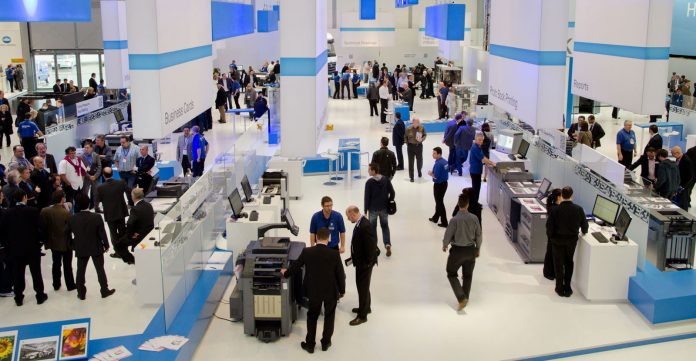

Ricoh, followed by Canon and then Konica Minolta, withdrew from the event, all explaining that the need to ensure the safety of their staff and customers, was prime. These follow hard on the heels of Fujifilm, HP and the earlier declared absence of Kodak and Xerox, meaning that the digital printing cupboard is looking increasingly bare.

Currently Xeikon, Miyakoshi, Kyocera, Riso, BlueCrest (an OEM of HP’s PageWide technology), and Delphax (supported by Memjet) are the only digital press providers listed on Drupa’s website along with Manroland WebSystems, Koenig & Bauer, Manugraph, and RMGT, as providers of litho printing presses.

In statements last week, Ricoh declared it “is renewing its focus on developing increasingly effective virtual client communication via different channels, with Konica Minolta Business Systems international marketing division general manager Olaf Lorenz saying “exhibiting at Drupa or any other trade fair at the moment makes no sense to us during the current world uncertainty. Things are too unpredictable.”

And this is the nub for many, even those that are still listed as participating. Agfa would be the only major litho plates supplier but says that it needs to be convinced that Drupa can attract enough visitors and that the show can be organized in a safe way. It is in conversations with the organizers on these points.

The visitors’ issue is out of the hands of the organizer. While Germany is one of the countries that the UK based people can currently visit without quarantine, this is not the case for visitors from the US. With the number of infections and deaths still increasing sharply in the US and with little indication that authorities have the spread of Covid under control, visitor restrictions are unlikely to change in the short term.

This will also increase costs for US exhibitors who will need to isolate staff once they reach Germany.

Many of the companies listed as at the show have still to confirm their attendance. Currently, UK based companies have remained, along with many European and Chinese exhibitors. This may change, Japanese companies in particular are, by nature, conservative and will prioritize the well being of employees. Epson, Mimaki and RMGT are among those still to confirm either way.

If digital printing and litho printing are thin on the ground as it currently stands, finishing technology has a stronger representation. Muller Martini, Polar, Kama and Kolbus head the conventional finishing suppliers; Hunkeler, Horizon, Tecnau and Duplo International those with a digital focus. MB and GUK as providers of folding systems with Kern, Buhrs, BlueCrest and Böwe from the mailing world.

Digital prepress has a fair showing, due perhaps to running simpler stands with less need of a lengthy setup. Esko Artwork, Enfocus, GMG, Global Graphics and Chili Publish, the first company to pull out of Drupa this year, are attending. For now.