A. Inflation expectations

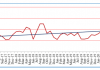

One year ahead business inflation expectations in July 2020, as estimated from the mean of the individual probability distribution of unit cost increase, have declined sharply by 42 basis points to 3.70% from 4.12% reported in June 2020. After running over 4% since March 2020, business inflation expectations fell below 4% in July 2020. The trajectory of one year ahead of business inflation expectations is presented in Chart 1.

Uncertainty of business inflation expectations, as captured by the square root of the average variance of the individual probability distribution of unit cost increase, has remained the same around 2.1% during June-July 2020.

B. Costs

The cost perceptions data shows some signs of moderation of cost pressures.

In this round of the survey, roughly 1/3rd of the firms still expect a significant (over 6%) cost increase as compared to the same time last year. This proportion has been gradually declining after March 2020. Around 53% of the firms now believe that the current cost increase is 3.1% and above as compared to the same time last year – down from 58% reported in June 2020 (Chart 2).

C. Sales Levels

Over 66% of the firms in July 2020 report that sales are ‘much less than normal’ as against over 81% firms reporting in March 2020.

While there seems to be some gradual improvement of sales, around 85% of the firms in the sample still report that sales are ‘somewhat or much less than normal’ (Chart 3). Note that this proportion has remained over 70% since June 2019.

D. Profit Margins

Over 62% of firms in the sample in July 2020 reported ‘much less than normal’ profit as against 68% in June 2020.

Over 83% of the firms in the sample in July 2020 expect ‘much less than normal or somewhat less than normal’ profit margins – down from 86% that reported in June 2020 (Chart 4). Note that this proportion was hovering around 75% from June 2019 till January 2020, thereafter it went up further.

1 The Business Inflation Expectations Survey (BIES) provides ways to examine the amount of slack in the economy by polling a panel of business leaders about their inflation expectations in the short and medium-term. This monthly survey asks questions about year-ahead cost expectations and the factors influencing price changes, such as profit, sales levels, etc. The survey is unique in that it goes straight to businesses – the price setters – rather than to consumers or households, to understand their expectations of the price level changes. One major advantage of BIES is that one can get a probabilistic assessment of inflation expectations and thus get a measure of uncertainty. It also provides an indirect assessment of the overall demand condition of the economy. The results of this Survey are, therefore, useful in understanding the inflation expectations of businesses and complement other macro data required for policymaking. With this objective, the BIES was introduced at IIMA from May 2017. The questionnaire of BIES is finalized based on the detailed feedback received from the industry, academicians and policymakers. A copy of the questionnaire is enclosed.

Companies are selected primarily from the manufacturing sector. The ‘BIES – July 2020’ is the 38th round of the Survey. These results are based on the responses of around 1300 companies.

2 ‘Normal’ means as compared to the average level obtained in the preceding 3 years. Data of perceptions on sales and profit is not available for April 2020.