As of 1 August 2020, Komori takes over the MBO Group and its subsidiary Herzog+Heymann. MBO offers folders, including solutions for inserts and outserts used in pharma packaging. Komori India says that it is starting the sales of MBO equipment from 1 August itself.

The company claims that H+H has more than a 50% market share in its segment in India. H+H is a specialist in specialized solutions and mailing and gluing systems. It provides small-sized folders and large-size folding machines for maps and posters.

Komori plans to strengthen its standing in the packaging market by providing total pharma packaging solutions. The pharma solutions also comprise shop floor sorting, filling, and end-user packaging solutions.

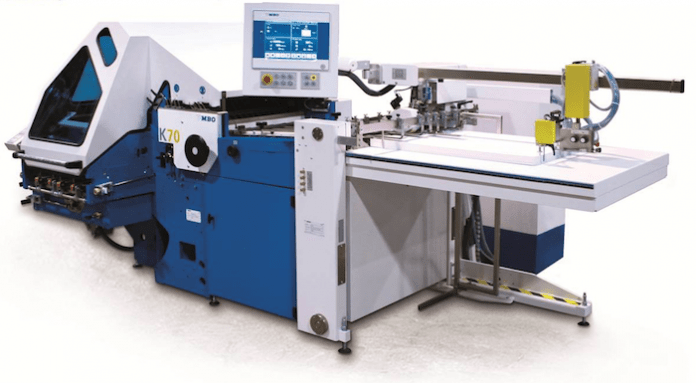

MBO produces conventional folders and web finishing solutions, including finishing aggregates, deliveries, and peripherals. Apart from reliable solutions for price-sensitive customers, MBO has its CoBo-Stack robotic stacking solution, planning and analysis software, and data manager 4.0.

With its acquisition of the MBO Group, Komori expects to introduce post-press solutions for commercial and packaging printing. It plans to couple these with its IoT-based cloud solutions such as KP-Connect to provide seamless print production workflows that include post-press processing.

Well trained MBO service technicians and original spare parts with Komori India’s backing should benefit customers. The company plans to increase its footprint in both the pharma and non-pharma verticals. It expects that one of the outcomes of the Covid-19 pandemic is the growth of the Indian pharma and pharma packaging market. Additionally, there is an opportunity to replace numerous second-hand folders in the market.