Xerox has released its financial results for its second quarter and announced a strategic agreement to rebadge an inkjet press from Kyocera Document Solutions.

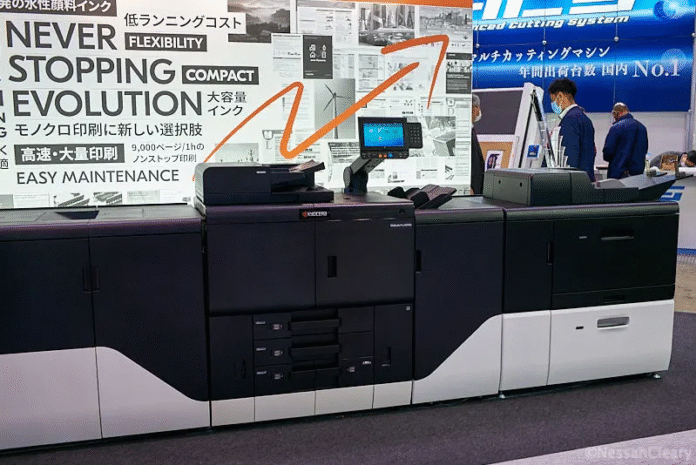

Xerox has not said which of the Kyocera inkjet printers it plans to sell. Perhaps the most likely would be the TaskAlfa Pro15000c, which has proven to be very successful with many installations worldwide. It’s a very compact, inexpensive press that’s as easy to operate as a standard office printer but is aimed at production printing. However, for the best results, it is limited to inkjet-coated stocks, which pushes up the running costs. For this reason, it’s mostly been used for transactional work, and, consequently, Kyocera has refocused and now primarily promotes it for transactional printing. Nonetheless, it would still be a very good fit for Xerox, which appears to be primarily concentrating on the office market.

The press itself is an integrated printer/ copier with a monthly duty cycle of 1 million pages per month. It takes SRA3-sized sheets and can print 75ppm simplex, which equates to 150 A4 ppm in both colour and black and white. Naturally, it uses Kyocera printheads, with resolution up to 600 x 600 dpi. It prints CMYK, using water-based pigment inks.

There’s also a monochrome version of the Pro 15000, which uses the same engine but just the one set of printheads so the print speeds and specifications are the same.

The other alternative would be the TaskAlfa Pro 55000c, which was shown at last year’s drupa show. This is based on the Pro 15000c but with the addition of Screen’s SC ink, which was originally developed for its TruePress Jet 520 presses. Consequently, there’s no pretreatment needed, and the printer will handle both coated and uncoated papers, which does make it a relatively unique machine in this class. It’s primarily aimed at high-quality applications such as books and magazines.

The new 55000c runs at the same speed as the existing 15000c of 150 A4 simplex ppm. It takes sheets up to SRA3 size, with a maximum print width of 326.1mm. There’s an optional multi-purpose tray that can take banners up to 1220 mm. It can handle media from 50 to 400 gsm. The standard configuration will hold 6100 sheets, but there’s a good choice of different paper drawers so that it can hold up to 11,810 sheets.

This should be available now, but it’s not yet listed for sale on any of Kyocera’s websites. Screen also sells its own version as the Truepress Jet S320, and is marketing it to Japanese customers, though it’s not yet available in Europe.

Whichever press Xerox does opt to use, it will use the same Fiery front end that Kyocera and Screen are using, albeit badged for Xerox. However, Xerox will add its own FreeFlow automation modules to help differentiate itself from the other vendors’ variants. Xerox will also take care of the servicing for the units it sells.

Terry Antinora, senior vice president and head of product and engineering at Xerox, commented, “Our re-entry into the cut-sheet inkjet market allows us to diversify our portfolio, meet growing client demand for speed and efficiency, and reinforce our commitment to leadership in digital production.”

It’s worth noting that Xerox is not the first partner to be interested in the Kyocera TaskAlfa Pro 15000c. Bluecrest, which specialises in enterprise-level printing and mailing solutions, sells the 15000c as its EvoluJet across a number of different regions. The American company MCS, which started as Micro Computer Solutions, also rebadged the 15000c as its Merlin K146c. Interestingly, Ricoh also sells the 15000c, but only in North America.

Readers might be tempted to see a neat twist of fate here, since Xerox had originally acquired the French company Impika in 2013 to spearhead its move into production inkjet presses. However, Xerox abandoned this and shut down the French operation in 2019. The French staff simply got back to work, setting up a new company, Nixka, in 2020 in the same premises with the same management. Nixka was then acquired by Kyocera in 2023.

But this is not a case of Xerox simply returning to the people it already knows, since there is very little integration between the various companies that Kyocera has acquired. So Kyocera Document Solutions, which is headquartered in Osaka, Japan, was originally Mita Industrial before being acquired by Kyocera in 2000. As such, it is quite separate from Kyocera Nixka, based in Aubagne, France, and the development of the TaskAlfa inkjets predated Kyocera’s Nixka acquisition by some years.

As well as the Kyocera agreement, Xerox reported revenue of US$ 1.58 billion, which is down 0.1% year on year. The bulk of this – US$ 1.37 billion – comes from the print business, with just $336 million in print sales and the rest in post-sale income, presumably meaning click charges for servicing. However, the overall result, according to generally accepted accounting practices, was a net loss of US$ 106 million.

Despite this, Xerox does appear reasonably bullish about its prospects, stating that its acquisition of Lexmark forms ‘a vertically integrated manufacturer, distributor and provider of print equipment and managed print services, covering all geographies and client types with a well-rounded portfolio of print and print services offerings.’

It’s too early to say if Lexmark will really deliver all of this for Xerox, but it should give it a baseline that can be expanded on with other agreements, such as that with Kyocera. In any case, Xerox has set out a three-year plan to integrate Lexmark, starting with eliminating duplication this year, optimizing the supply chain and R&D next year, and then consolidating the real estate footprint and IT infrastructure in 2027. This could all lead to savings of US$ 250 million in synergies between the two organizations.

Xerox also claims to have a growing portfolio of IT and Digital Solutions, noting that these areas are more than 10x the size of the print market.

However, Xerox noted in its analyst presentation that it expects “to incur roughly US$ 30 to 35 million of tariff expenses.” But the company adds, “Assuming rates remain unchanged, we expect to recover the net impact of 2025 tariff expenses in 2026.”

In the meantime, Xerox has said that it will announce further details of its arrangement with Kyocera later this year.