The Indian government’s National Council for Educational Research and Training is tripling its book production from the current supply of 5 to 6 crore (50 to 60 million) copies to 15 crore (150 million). Hopefully, this will become an annual production as enrollment and stay-in-school figures improve in the various government and private schools in the country.

The NCERT books are used mainly for the CBSE curriculum and in the Kendriya Vidyalaya schools run by the central government and are also mandatory for the 8th to 12th standards for private schools. The current level of more than 30,000 CBSE schools is also growing throughout the country where there seems to be a noticeable preference for that curriculum.

The overall production of schoolbooks in India is of a much higher order than just the central government’s NCERT books, and perhaps closer or even more than 300 crore (3 billion) copies – mainly supplied by state education departments and private schoolbook publishers. One might say that there is a consensus amongst educators, publishers, and book printers that these volumes need to be at least doubled.

Most of the book printers and publishers our team has spoken to in the past several months are continuing to expand their book production although some are diversifying to other print segments such as labels and packaging. However, if one does the research and understands the compelling case for education in India and the current low level of school completion in India and its inevitable rise, it is clear that a significant demand upsurge for printed textbooks is already underway.

The tripling of NCERT book production reinforces this optimism, especially as this is not just a government announcement but a program that is well underway with 15 to 20 book printers already selected from a much bigger list, based on their production capacities and efficiencies. Most of the negotiations and paperwork are sorted and only the print orders are awaited.

The long-time proponent of book production, Sajith Pallippuram of Bindwel is quite forthright in his suggestion to printers to focus on this opportunity, “It is time for investment to shift focus toward the booming book print segment, which offers unparalleled growth opportunities. With over 260 million students in K-12 education and the GER of just 2.7 crore in 2021-22, the government’s ambitious target to raise it to 5 by 2030 will require nearly doubling the supply of government textbooks, from the current 2 billion books per annum.”

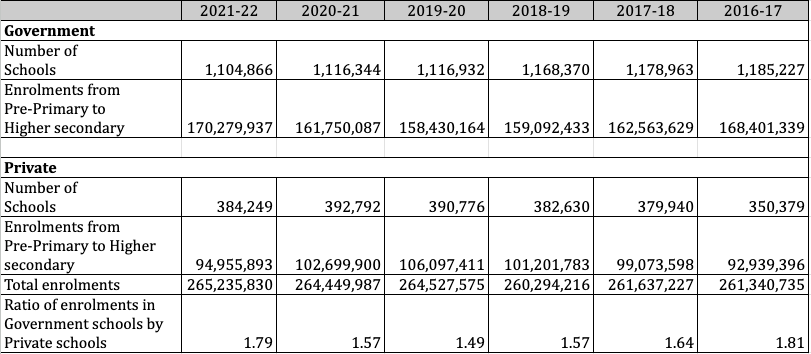

Number of schools and enrolments in government and private schools from 2016-17 to 2021-22

Sajith’s use of a GER of 2.7 means that only 2.7 out of every 10 children enrolled in standard 1, complete the 12th standard. And, if this has to rise to 5 by 2030, the implication is that the current production of 2 billion government textbooks will have to be at least doubled to 4 billion copies annually, and more likely have to rise to at least 5 billion – since more students will surely go on to the higher grades – even if they do not complete school.

Government figures indicate the number of school students enrolled (primary to higher secondary) in 2020-21 was 253 million which rose to 255.7 million in the following year. The 1.18 million government schools in 2016-2017 declined to 1.10 million in 2021-22. However, since that year, and because of various income constraints during the Covid-19 pandemic, children shifted back to government schools, which showed an increase for a couple of years. The number of private schools, which generally have far higher retention to the higher classes and completion than government schools, has increased from .350 million to .384 million schools.

Sajith’s optimism is borne out when we speak with major book publishers and printers in the New Delhi National Capital Region, who are experiencing an annual growth of 10% in book production volume with perhaps even higher growth in value. In addition, they speak about a new “hybrid model for textbooks” that consists of several types of teaching aids, workbooks, online material, and videos.

Sajith Pallippuram adds, “This surge in textbook demand will inevitably create a ripple effect across private educational publishing, including the booming market for guides and supplementary material. In contrast, industries such as monocartons and rigid boxes do not present anywhere near this scale of growth potential. Printers and investors who recognize this shift early, stand to benefit enormously as the educational publishing sector, including private guides and materials, experience an unprecedented surge.”