Big corporates will continue to be anchor customers for the printing industry but the most exciting growth opportunities for printers are being offered by medium and small-scale companies, thanks to the passion they have for their brands, says Shailesh Sharma, founder of Inndus Cards & Gifts.

“Medium and small-scale enterprises these days are passionate about their brands and want their brands to have a strong presence and great recall value. This is where the real market now is. Owner-centric firms where expectations are clearly set by the founders, want a lot out of the print communication. And this is turning out to be a big market,” Sharma argues.

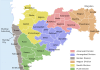

Based in the western Mumbai suburb of Goregaon, Inndus has a fledgling digital printing operation, in addition to offset and wide printing divisions. The company has been catering to industries such as banks, hospitality and technology, among others. In the past year or so Inndus has been engaging extensively with medium and small-scale companies. “My assessment about the strong potential that medium and small-scale sectors have is based on the solid interaction I’ve had with them in the last six to eight months,” Sharma adds.

However, this does not mean big brands should be ignored by printers as they will continue to be a strong customer base for the printing industry. According to Sharma, big brands have a set parameter and they must maintain consistency all across, which leads to inflexibility and which is why they cannot go beyond what they have been guided as a brand. “Big brands are rigid when it comes to new ideas. It is their inherent nature. But medium and small-scale companies are dynamic and open to new thoughts. In fact, they are hungry for it. They haven’t seen what the world has been doing,” Sharma says.

One of the most important reasons why printers did not actively pursue smaller brand owners earlier was that the cost of acquiring them was high vis-à-vis large customers. This has changed significantly with the advent of the internet. “With the world getting increasingly online, the cost of acquiring smaller customers has dropped markedly. And this trend is all set to continue,” Sharma argues.

Customers pay for the value

For many years now, there has been a constant discussion centred around how printers are competing on prices which is impacting the health of the industry. Sharma however has a slightly different take on this issue.

“There is no benchmark to assess if a print is cheap or expensive. There will always be an expensive market and then there will always be a cheap market and that will depend on how the print buyer values the printed product. There is a pie for everyone; a printer must choose who he or she wants to cater to. It is a very healthy market. Just that this price war is happening between entities who want to offer their services to the cheapest buyer. These entities can keep fighting that fight,” Sharma says.

Internet is the future for printers

Cheap access to internet has completely changed how people work, interact, study and do all sorts of other things. Sharma believes the internet will change the way customers buy print as well and it has become a requirement for printers to have an online presence if they want to thrive in the market.

“Internet and mobile apps are going to be the market for tomorrow. However, printers will need to strengthen their post-print processes if they want to leverage the growth because they will have to deliver a finished product. They will be service providers than just a printer. You will see a huge change in the Indian print market in the next five year fueled by internet and mobile applications,” he says.

New investments in digital department at Inndus

At present Inndus has a Xerox Versant 80 and IGen 4 deployed in is digital department. Sharma shares that the company will start thinking about new investment at the end of the current financial year. Being a long time Xerox customer, he said he will surely look at the newly launched Xerox Iridesse press.

“Iridesse is a great product and has a lot of potential in the Indian market. Before making any decision about it, I would like to see how it evolves in the next three to four months and then maybe think about it,” he concludes.