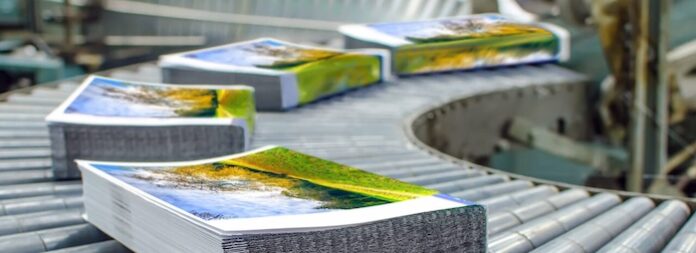

As part of our efforts to reach major printing hubs across India, Indian Printer & Publisher recently visited Delhi’s Okhla, a major commercial printing hub. A series of discussions with several leading printers in the area provided us with valuable insights into industry trends. While traditional commercial print segments such as advertising collateral, pamphlets, and brochures continue to decline, book printing—particularly in the education sector—is showing signs of resilience and even cautious growth.

One of the most prominent trends that nearly all printers pointed out is the decline of general commercial printing jobs. Varun Johar, managing director, Microprints, notes a steady decline in demand for printed advertising materials such as brochures, flyers, and price lists. “These materials are increasingly being pushed through digital platforms, WhatsApp catalogs, social media, and interactive apps,” he says.

Johar illustrates this shift with an example of liquor shops in Gurgaon, which previously relied on printed banners. They now prefer digital displays integrated into their modern retail environments. This transition reflects the broader digital migration of marketing communication.

Despite this contraction, the printing units in Okhla have not remained passive. Some are diversifying their offerings to retain relevance. Microprints, for instance, recently launched a consumer brand—The Mood Twister—focused on customizable notebooks, diaries, and planners. Targeted at both individual and corporate buyers, the products are sold across online marketplaces, with personalization, aesthetics, and gift appeal.

Book printing is going strong

While commercial printing has gone down, book printing has emerged as a relatively stable and promising vertical. Several printers report consistent demand, especially for textbooks and academic materials.

Johar attributes this resurgence to the failures of digital edutech platforms that had gained traction during the Covid-19 lockdowns. “Smart education systems promised transformation, but in practice, they failed to deliver the same discipline, engagement, and clarity that printed textbooks offer,” he says. According to him, schools and colleges are returning to traditional learning models, placing renewed trust in physical books.

Vinay Baveja, managing director, Viba Press, agrees that book printing is going strong. “There’s no decline in book printing—neither now nor in the foreseeable future,” he believes. According to him, despite the drop in promotional materials, books offer a more stable and continuous workflow.

Across the board, printers agree that the book printing industry is stable. Johar says, “The book printing segment is not growing rapidly, but it is stable—and that’s important. After the pandemic-led slump, regaining this baseline is, in itself, commendable.”

Digital complements offset

The rise of digital printing has often been viewed as a threat to traditional offset operations. However, Gurpinder Vohra, director of Kriti Offset, presents a more balanced perspective. In his view, digital printing has not overtaken the commercial industry but is rather “complementing” it.

“Offset printing continues to dominate in terms of cost-efficiency, quality, and turnaround for medium to large volumes,” Vohra says. “Yes, digital is growing, but it hasn’t replaced offset—it simply serves different needs.”

He emphasizes that offset technology has evolved significantly. Automated workflows, faster setups, and advanced color control systems have enabled offset presses to handle even relatively short-run jobs, which were once considered uneconomical for the format. “Printing 200 to 500 copies in offset is now viable with the right setup,” he explains.

Vohra points out that while digital printing has lower upfront investment, offset still offers better margins over time for printers handling higher volumes. The core strength of offset—its ability to deliver high-quality print consistently at scale—remains unmatched.

Recovery is slow but stable

Commercial printers in Okhla feel that the post-pandemic recovery, while slow and segmented, is not without its positives. The key is to focus on core competencies—quality, reliability, and speed of delivery—while remaining open to diversification and new business models.

For some, this means investing in other products or exploring new verticals such as packaging. Baveja openly admits his interest in packaging. “It’s a growing segment, and if the opportunity comes, we are ready. Much of our infrastructure is compatible—we just need the right entry point.”

Most printers Indian Printer & Publisher visited said they no longer rely solely on volume-driven jobs but are instead exploring quality, niche markets, and hybrid business models. As Johar concludes, “Trends change every 10 or 20 years. Commercial printing may still see a revival. But till then, we’ll stay focused, deliver quality, and keep evolving.”