The book publishing business in India has seen double digit growth across all segments as a young population is consuming more and more books. Welbound Worldwide, although far removed from the end consumer, has been working closely with two crucial links — the publisher and the printer. elbound is a highly respected name in the postpress machinery

manufacturing space. It manufactures products that complete the entire postpress cycle from folding to trimming of books. The product portfolio range includes high speed automatic folding, offline gathering, wire stitching, perfect binding and three knife trimmers. The company will complete 25 years of existence this year.

“Trade publishing is also growing in English as well as Indian languages. Here, the runs are getting shorter while the number of titles go up. The

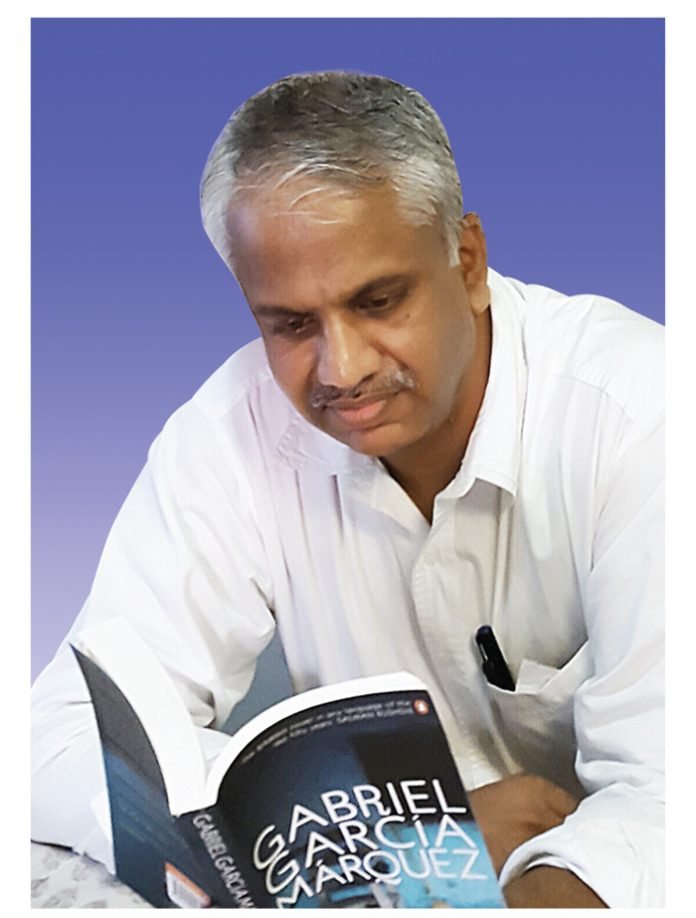

retail sales of trade publishing has clocked a robust growth of 16% according to Nielsen Bookscan. Self- publishing, online retail, growth in literacy, an affluent urban market, are all helping this growth. Children’s books are also growing at a phenomenal pace,” says Welbound’s director, marketing and sales, P Sajith.

Education market

About the education market, Sajith says increasing investment by the government as well as the private sector and higher enrolments have resulted in the education market growing at 16% CAGR (compound annual growth rate). “Education is also a market that is exposed to proliferation of digital solutions — be it electronic classrooms, e-tools or e- books. From the publishing perspective, there are sub segments within education like pre-primary, K12 (primary to Class XII), higher education, academic and reference books and so on. We are seeing significant growth of printed books in both K12 and higher education, and these are by far the largest sub segments, both in terms of value and numbers,” points Sajith.

According to Sajith, K12 education is largely controlled by the government which also controls the publishing of textbooks. “State government education departments form the largest block of print buyers with approximate print buying of close to Rs 3,000 crores in FY 2013-14.

Government textbooks consume close to half a million tonnes of paper in a year, and this is slated to grow in the coming years.” Then there are private educational publishers, both global and Indian leaders — like OUP, Pearson Education, S Chand, MBD books and Orient Blackswan who have all registered impressive growth in the year, Sajith adds.

Challenges and opportunities

Amid the optimistic growth environment, book publishing has to deal with challenges. “From the perspective of a printer, educational publishing offers some challenges; be it in terms of cost constraints, turnaround requirements, quality aspirations and so on. It is tough to realize value; however the volumes are huge. We will need to run the printing press like a super-efficient and lean manufacturing plant. Managing the workflow, turnaround times, eliminating wastage will gain importance over dot gains,” Sajith explains.

Another point that Sajith highlights, especially from the point of view of private educational publishers, is that of cost mitigation. “For the private educational publishers mitigating costs are top priority, thanks to competition pressures on the one end and the huge impact paper prices had across last year. Publishers, printers and suppliers need to work more closely — understand the pain points in the value chain and seek solutions,” says Sajith.

Commenting on the overall state of the industry, Sajith says book printing will drive most of the growth in the printing industry. “Consumption of printing and writing paper in India was about 4.5 million metric tonnes in 2013. The paper pundits are expecting the total consumption of paper to grow from 12 metric tonnes an annum to 21 metric tonnes an annum by 2021. India will contribute 20% of the growth of global demand for printing and writing paper in the next five years.

This will be consumed largely by education,” he says.

Contribution and plans

With a solid growth potential ahead, what role does Welbound sees for itself in contributing towards the book and education industry? Sajith says, “We have been doing this quite earnestly and effectively — be it organizing the trade to drive export growth, working with them to introduce cost efficient processes, auditing and maintaining plants, training their manpower or bringing them together to discuss the common pain points. We are the leading supplier of bookbinding machines and services in the country and along with Henkel Adhesives, we have a considerable role to play in book production in India. We will do our best in enhancing the overall efficiencies in the printed book publishing value chain.”

Talking about Welbound’s plans in the coming future, Sajith says, “The company will focus on delivering solutions that will further the scope of our customer’s business. We are glued on to our customer’s business and we understand how to apply glue on to paper. Our future endeavours will be building on these strengths,” he sums up.