Brother Industries has announced an offer to acquire all the assets of Mutoh Holdings, which includes the Mutoh Industries large-format printer business, its overseas subsidiaries, and associated buildings and other assets, including intellectual property.

Brother has offered ¥7626 per share or approximately ¥35 billion in total, equivalent to around US$223 million. However, this assumes that Brother manages to buy all 4,589,644 shares. But it has set a minimum of 3,042,700, which is 66.29% of the shares, and Brother will only conclude the purchase if it achieves this minimum. Brother already has the backing of the major shareholders, and the board of Mutoh Holdings will recommend that shareholders accept it.

At first glance, this does seem like a very high price, given that the Mutoh shares were only worth ¥2962 at the start of trading on the 4th of February, although they rose to ¥2980 by the close of the business day in Tokyo. Brother says that it calculated the purchase price based on the business value, as well as the transfer price of Mutoh’s head office building, which is included in the deal, plus various other unspecified factors. This presumably refers to Mutoh’s portfolio of office buildings, commercial facilities, and childcare centres for lease in Tokyo and other regions.

Brother, which does not currently hold any stock in Mutoh, has said that it will use its own funds for this acquisition and that it intends to make Mutoh a wholly-owned subsidiary. Brother’s announcement sets out the justification for the acquisition, namely that it will be able to rationalize sales and manufacturing across the two companies, and will be able to realize economies of scale through joint procurement and standardization of parts.

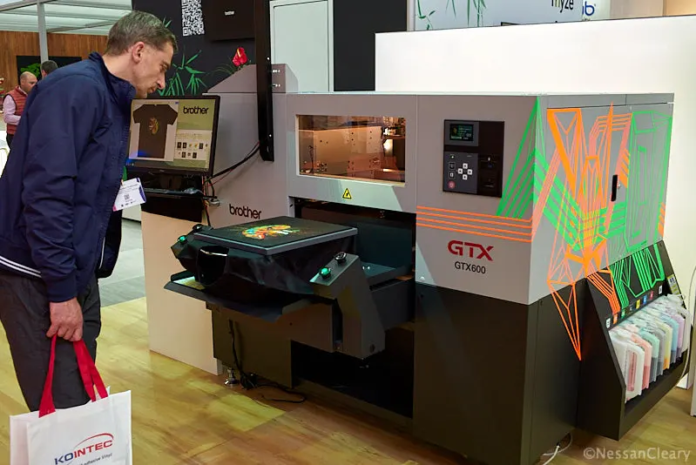

This bid is part of a wider strategy from Brother Industries to expand into the industrial print market. Brother, which has a large consumer portfolio of garment printers and sewing machines, has published an ambitious plan to restructure its business and grow its revenues to ¥1 trillion by 2027, with an operating profit of ¥100 billion by 2027 and ¥120 billion by 2030. The idea is that by 2027, some 40% of this, rising to 50% by 2030, will come from industrial products. This includes Brother’s Domino subsidiary in the UK, as well as printing and automation, commercial and industrial labelling, and some industrial machinery and industrial sewing machines.

However, it’s one thing to see the potential profit in the industrial print market, but quite another to actually succeed there. In my view, Brother is hampered by having the mentality of a company that mainly serves consumer markets. Industrial customers are a lot more demanding, much closer to other industry players, including consultants and journalists, and much more aware of how the different suppliers operate. Plus, the industrial print market is growing rapidly and evolving into higher volumes, with more non-traditional substrates and more challenging applications.

Moreover, to achieve this ambitious expansion by 2030, Brother would have to buy its way into markets that it is not currently in. Back in March 2024, the company had attempted to acquire Roland DG, which rebuffed its offer. Undeterred, Brother made a hostile offer, which would have amounted to at least ¥32 billion, but abandoned this in May 2024, and Roland DG went ahead with the MBO that it had been planning. So that left Mutoh as the next most logical choice.

Brother’s extremely long-winded press release does include the history of its offer, which appears to have started back in November 2024 when Mutoh began looking for a partner to help increase its corporate value, amid fears that its largest shareholder, Integral, which holds 35.33% of Mutoh stock through its TCS Funds subsidiary, might sell its shares. By the summer of 2025, Mutoh approached six companies that had expressed an interest, receiving letters of intent from Brother and one other company, plus one private equity fund that had dropped out by October 2025.

Brother started by offering ¥5268 per share, rising to ¥6,971 per share, and then to ¥7280 in December 2025 when Mutoh’s management asked for more money. However, the other company then suggested ¥7625, despite the bidding period having concluded by this stage. Nonetheless, Mutoh prompted Brother to come back with its current offer of ¥7626 per share. In addition, Brother entered into support agreements with both Integral and with Hoei Jitsugyo, which holds a further 6.35% of Mutoh stock, to shore up its position. At this stage, Mutoh appears to have asked for yet more money, but Brother refused to increase its offer.

The current offer is dated 4th February 2026, which ties in with Mutoh’s release of its latest financial results for its third quarter, ending 31 December 2025. The figures reveal a 3.3% drop in year-on-year net sales and a 32.6% fall in operating profit from ¥1075 million (Euros 5.81 million/ £5.02 million/ $6.85 million ) to ¥725 million (Euros 3.91 million/ £3.38 million/ US$4.62 million).

All this begs the question: Will Mutoh give Brother the kind of growth that it craves? Mutoh is an established large-format printer manufacturer, but it is dwarfed by the sheer size of Epson and lacks the nimbleness of Mimaki or even Roland DG. Brother notes that Mutoh itself has identified a number of challenges, including an overall contraction in the large-format market, as well as increasing competition from Chinese manufacturers and rising costs. I would add a further problem in that the large-format market is moving towards bigger, higher volume presses, with more consolidation amongst print shops, which does not favour Mutoh’s offerings.

Mutoh mainly competes on price and operates at the lower volume end of the market, though it has introduced a number of innovative ink technologies into the wide-format market in recent years. This includes the 1.62m wide Hydraton 1642 that uses Fujifilm’s AquaFuze hybrid aqueous/ UV ink. However, this largely came about as a contract manufacturing deal where Mutoh built the Acuity Triton printer for Fujifilm, and as such, Fujifilm retains all the related IP around this ink. Fujifilm previously told me that it is using these printers to evaluate the ink and the market for it, with the possibility of developing a larger printer itself to take the technology forward.

Brother could conceivably replace the Epson printheads that Mutoh currently uses with its own, but that would take time, and assumes that the Brother heads could handle the range of inks that Mutoh is using and the applications it is serving.

Brother has said that it plans to invest some ¥200 billion, roughly US$1.3 billion, over three years. That would include mergers and acquisitions, as well as alliances to drive growth in the Industrial area. This money would also be used to strengthen its inkjet development and production technologies, as well as expand the sales and service bases serving its industrial business.

Brother itself dates to 1908 when it was founded as a sewing machine repair company, initially called Yasui Sewing Machine Co, which was changed to Nippon Sewing Machine Manufacturing Co. in January 1934, and changed again to Brother Industries Ltd in 1962.

Today it operates across seven segments, including: Printing & Solutions, which includes manufacturing and selling printers, all-in-ones, label printers, label writers, and scanners; Industrial Printing, which includes equipment such as coding and marking equipment, digital printing equipment, and garment printers; Machinery, which includes machine tools and industrial sewing machines; the Nissei division, which covers manufacturing and selling gearmotors and gears; Personal & Home, which is mainly home sewing machines; Network & Contents, mainly manufacturing, selling, and leasing karaoke systems for business use plus associated content services; and Other Business, covering manufacturing of various miscellaneous products as well as selling and leasing real estate.

You can find further details from the investor’s page at brother.com