Over the decade we have studied, the Indian newspaper industry has undergone a period of pronounced change — navigating shifts in advertising markets, evolving readership patterns, and the once-in-a-century disruption of the Covid-19 pandemic. Drawing on financial data from 49 leading newspaper groups, this analysis tracks the sector’s journey from FY 2013-14 through FY 2023-24, spotlighting the resilience, adaptability, and renewed momentum of an industry often underestimated in the digital era.

The IppStar (www.ippstar.org) study includes financial data for 49 prominent newspaper publishing houses representing a wide cross-section of India’s linguistic, regional, and market diversity — from national heavyweights such as Bennett Coleman (publisher of The Times of India and several other dailies) and DB Corp (Dainik Bhaskar in Hindi and several other languages) to strong regional brands such as Sandesh (Gujarati), Mathrubhumi (Malayalam), and Lokmat Media (Marathi, Hindi, English).

Financial data for FY 2023-24 is unavailable for Assam Tribune, Hari Bhoomi, Jagati Publications, Lok Prakashan, and Malar Publications. For these groups, the figures have been extrapolated using the average annual growth rate calculated from the last three available financial years. In addition, THG Publications has reported data only from FY 2016-17 onwards, New Age Media from FY 2015-16, and Manipal Media Network Limited from FY 2014-15. While these variations in coverage slightly limit long-term comparisons for a few publishers, they do not materially alter the broader industry trends observed.

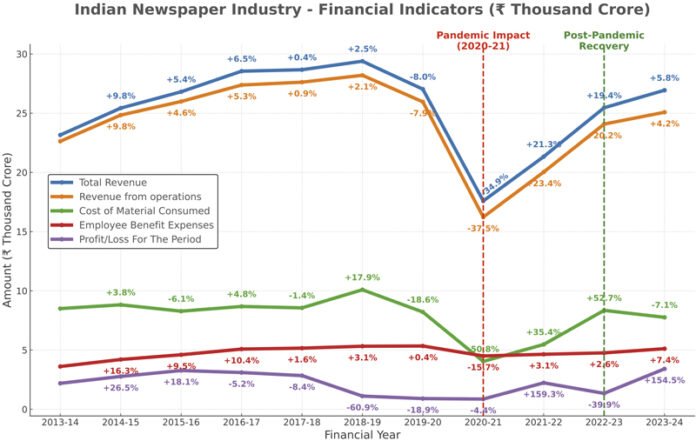

The ten-year period began with steady growth in total revenues, largely driven by rising ad spends and consistent circulation income. Between FY 2013-14 and FY 2018-19, most publishers experienced moderate to strong expansion. National players such as Bennett Coleman, HT Media, and Jagran Prakashan maintained market dominance, aided by diversified language portfolios and strong urban readership. Our sample of 49 newspaper groups publishes 80 dailies and represents approximately 79% of the entire Indian newspaper industry.

Regional publishers also performed strongly during this period, often outpacing national dailies in percentage growth thanks to deep market penetration in their states. Lokmat Media and Sandesh leveraged robust local advertising ecosystems, while southern publishers such as Malayala Manorama and Mathrubhumi benefited from brand loyalty and high literacy rates in their core geographies.

Of note is Business Standard, with its high newsstand price and continued strength in ad pagination comprising statutory financial statements, which has shown profitability for the third consecutive year. While its recent profitability is dwarfed by its accumulated losses, Business Standard has added a Jaipur edition, its fourteenth, on 20 August 2025.

The pandemic decline led to a structural change

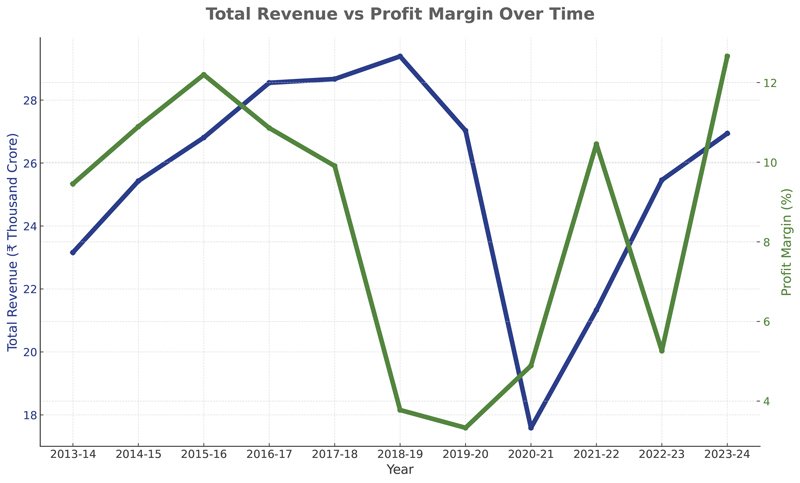

The FY 2020-21 marked the industry’s steepest collective decline in decades. The Covid-19 lockdowns disrupted distribution, causing a sharp drop in advertising revenue, and prompted many readers to shift temporarily to free online news sources. Even the largest groups, such as Bennett Coleman and DB Corp, saw revenue contractions exceeding 30% from their peaks. Smaller and mid-sized publishers dependent on local ad markets faced proportionally greater challenges.

The decline was not uniform across all indicators. While total revenues and operating profits fell sharply, many publishers acted swiftly to contain losses — suspending low-performing editions, renegotiating supplier contracts, and accelerating digital initiatives to keep audiences engaged.

The first signs of recovery emerged in FY 2021-22, although many players remained below pre-pandemic revenue levels. By FY 2022-23, recovery had gathered pace, driven by the return of local business advertising, festive-season campaigns, and election-related ad spending in key states.

Strong return to a growth trajectory

FY 2023-24, even with partial estimates for some publishers, shows a strong return to growth. Several major groups — including DB Corp, Rajasthan Patrika, Sandesh, and Lokmat Media — posted results approaching or exceeding pre-pandemic highs. This rebound was underpinned by a resurgence in regional advertising demand, revival in public event sponsorships, and greater willingness among brands to invest in trusted print platforms for targeted reach.

When ranked by total revenue for FY 2023-24, Bennett Coleman maintained a commanding lead, followed by DB Corp, Jagran Prakashan, Ushodaya Enterprises (Eenadu), and Malayala Manorama. On the profitability front, the leaders included many of these same names, though some regional publishers achieved higher margins thanks to leaner cost structures and strong local ad market dominance.

At the smaller end of the market, niche and regional-only publishers continued to face tight margins. For them, managing print costs while growing sustainable digital revenue streams remains a critical challenge.

A key trend over the decade is the relative resilience of multi-language, multi-title groups. Their diversified portfolios allow them to balance dips in one market or language segment with growth in another. In contrast, single-language publishers in smaller markets often experienced sharper revenue swings, especially when regional economies slowed or election-related ad spending declined.

Some of the sharpest recoveries post-pandemic came from regional leaders with strong reader loyalty. Sandesh (Gujarati) and Rajasthan Patrika (Hindi) reported substantial FY 2023-24 rebounds, demonstrating the staying power of trusted local brands in retaining advertiser confidence.

While the data focuses on traditional financial indicators, the industry’s future is increasingly tied to its ability to monetize digital audiences. Publishers such as HT Media, The Hindu Group, and ABP have invested heavily in paywalls, subscription-driven apps, and video-led content strategies. Although digital currently forms a smaller share of total revenue for most Indian print media news publishers, its growth potential is significant, especially in urban and younger readership segments.

The last decade tested the Indian newspaper industry’s adaptability in ways few could have anticipated. From steady growth to pandemic-induced decline and now a robust recovery, the sector has shown both resilience and strategic agility.

The FY 2023-24 performance — even with some values extrapolated — confirms that print remains a critical medium in India’s media mix, especially in regional markets where local newspapers hold enduring trust. Large publishers are positioned to consolidate gains through hybrid print-digital strategies, while smaller ones may need to focus on niche positioning and operational efficiency.

The Indian newspaper industry has almost collectively made a structural shift to lower circulations and higher subscription prices, while maintaining its ad rates at previous levels. The data reveal that while human resource costs have remained steady or even risen despite layoffs, cutbacks, and increasing contractual employment since the pandemic, the lower pagination and circulations have led to a decrease in raw material costs at a time of mostly benign newsprint prices.

This has, by and large, resulted in increased profitability to earlier levels, even while overall revenues have not reached earlier highs. As the industry steps into the next decade, it carries the lessons of a turbulent era, and despite several challenges, the renewed confidence in a sector that continues to play a central role in informing India’s public discourse.