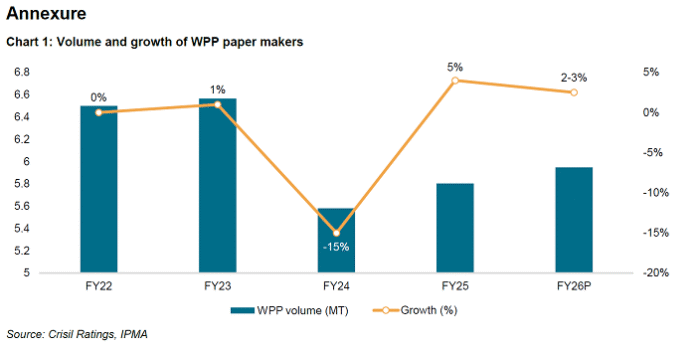

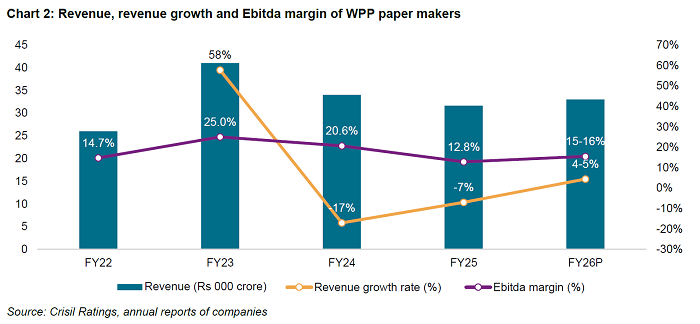

Indian writing and printing (W&P) paper manufacturers are expected to post revenue growth of 4–5% in the current financial year, reversing a 7% decline in FY2025, according to Crisil Ratings. The recovery will be supported by a 2-3% improvement in realizations and modest volume growth, aided by steady demand-supply dynamics, limited low-cost imports from ASEAN countries, and no significant domestic capacity addition.

“Realizations, which fell 12% last fiscal, will recover as the market adjusts to stable import volumes from ASEAN and a lack of cost competitiveness in non-ASEAN imports,” said Anand Kulkarni, director, Crisil Ratings. “Imports from ASEAN are expected to remain in the 18-20% range of total demand, while domestic manufacturers will benefit from steady output and reduced pricing pressure.”

The report noted that in FY25, lower global pulp prices, combined with high import volumes, exerted downward pressure on prices in the domestic market. The current fiscal year is likely to see a partial reversal of that trend.

Volume growth, projected at 2-3% this fiscal, will be lower than in FY25, when the implementation of the National Education Policy 2020 had driven higher textbook demand. “The structural shift towards digital formats is moderating demand growth, but segments like banking, education, and judiciary continue to provide steady business,” said Nitin Kansal, director, Crisil Ratings.

The agency projects an improvement in operating profitability by 200-250 basis points, as hardwood prices, a key raw material, stabilize after pandemic-driven peaks. “Price pressures on hardwood have eased, and operational efficiency measures such as better fiber recovery are improving yields,” Kansal said. “This, along with better realizations, will support a margin rebound.”

Capacity utilization is expected to remain high at around 86–87%, with manufacturers focusing on process improvements and debottlenecking instead of large-scale capacity expansion. The absence of new domestic capacity is expected to help maintain pricing discipline.

An analysis of 11 major W&P paper manufacturers, representing about 50% of the sector’s installed capacity, showed that cash flows are expected to improve in line with profitability. Low capital expenditure will help companies maintain healthy credit metrics. “We expect debt-to-EBITDA to stay at 1.3-1.4 times, with interest coverage improving to 7.5-8.0 times,” the report said.

The credit outlook remains stable, supported by a conservative approach to leverage. “Even though demand growth is modest, the combination of better margins, strong capacity utilization, and low debt will ensure healthy financial profiles for most manufacturers in the segment,” Kulkarni said.

However, Crisil Ratings cautioned that the sector remains vulnerable to two key risks. A rise in low-cost imports, particularly from ASEAN countries, could exert renewed pressure on domestic prices. Likewise, any fresh spike in hardwood prices could offset margin gains. “Both these factors will need to be watched closely,” the report added.

W&P paper is primarily used for printing textbooks, notebooks, and various forms and documents, making it dependent on the education sector, government printing orders, and certain corporate and institutional demand streams. While digitalization continues to affect long-term growth prospects, the near-term outlook remains supported by steady institutional consumption.

In FY25, the sector saw a combination of falling realizations and high input costs, leading to a sharp drop in revenue. The partial recovery in FY26, while modest, marks an important stabilization for an industry that has faced both cyclical and structural challenges over the past five years.