Nano Dimension has announced its financial results for 2024, which show the scale of the challenge facing the current management after the turmoil of the previous few years.

I think it’s fair to say that Nano Dimension has been through a fairly busy – some might say chaotic – period. To recap briefly, this started in 2022 when the company raised a substantial amount of cash to fund further acquisitions. That was followed by an offer from Murchinson, one of Nano Dimension’s largest shareholders, to acquire the company. The board at that time accused Murchinson of simply trying to take over the company’s cash reserves and then started a very aggressive effort to spend all that cash by acquiring Stratasys.

Not surprisingly, Stratasys turned down this offer, though Nano Dimension continued to make increasingly aggressive offers and to buy a lot of Stratasys’ stock throughout 2023. At the same time, Nano Dimension also acquired a number of other companies, including Additive Flow, Desktop Metal, and Markforged. However, the shareholders eventually sided with Murchinson after a vote in December 2024, leading to a shake-up in the management team and a change in strategy.

The 2024 annual report was itself delayed from its usual March date to the hard deadline of the end of April while the company completed its acquisition of Markforged. The results show that revenue for the year was up 3% over 2023 at US$ 57.8 million but that’s where any good news stops. The total cost of revenues rose from US$ 30.8 million in 2023 to US$ 32.8 million in 2024 while the gross profit fell from US$ 25.5 million to US$ 25 million.

The gross margin fell by 43 percent. The operating result improved from a loss of US$ 124.8 million to a mere loss of US$ 86.4 million. Altogether the company recorded a net loss of US$ 96.9 million, which was 74 percent worse than the US$ 55.6 million loss of 2023. Nano Dimension attributes this worsening of the net loss to a revaluation of its investments in Stratasys shares.

However, the company has begun a restructuring program in the fourth quarter and this has delivered some improvements. Thus the sales and marketing expenses fell slightly from US$ 31.7 million to US$ 29.9 million, while the general and admin expenses dropped from US$ 58.2 million to US$ 40 million. Other expenses improved from a loss of US$ 1.6 million to a plus of US$ 5.9 million.

The entire senior management team has been replaced since December. On 8 April, the board appointed the then chairman, Ofir Baharav, as the company’s new chief executive officer. The interim CEO, Julien Lederman, has now become the chief business officer.

Robert Pons, who joined the board as a director in December 2024, who has now taken over as chairman stated, “Baharav’s proven ability to drive strategic change and operational efficiency is precisely what Nano Dimension needs at this critical juncture.” Baharav has nearly three decades of experience in capital equipment, mainly in additive manufacturing and electronics. His previous roles include CEO of Maxify, VP products at Stratasys, CEO at Xjet, EVP products at Credence Systems, and president at Optonics.

The new management has undertaken a significant rethinking of the company, with Baharav stating, “We took a hard look at our product portfolio. Every offering must meet our vision of leadership in making industrial manufacturing solutions for advanced, complex parts.” He continued to say that the structure of the company had been streamlined, adding, “Less hierarchy, more execution, and a flatter, faster organization better equipped to innovate and deliver.”

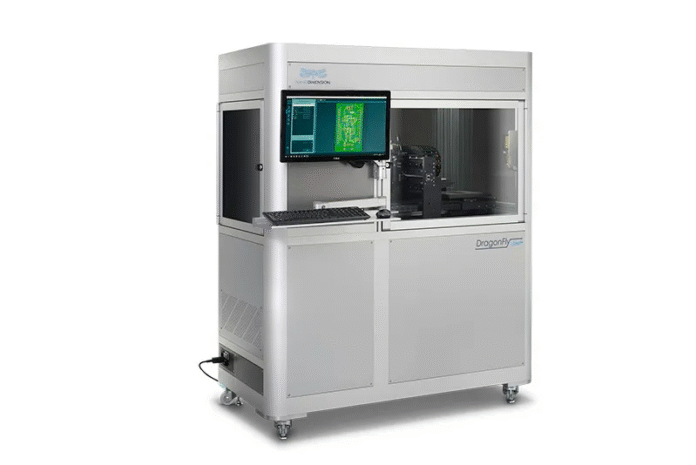

Thus the company will now focus on two core product groups: its own core additively manufactured electronics and the surface mount pick and place technology that Nano Dimension acquired with Essemtec. In the meantime, a number of product groups have been discontinued, including Admatec, Formatec, Deep Cube, and the Fabrica Group, which all came from earlier acquisitions.

Baharav added, “These moves – along with broader organizational efficiencies – enabled us to reduce the annualized operating expenses of our core business by over US$ 20 million and increase revenue per employee from US$ 147,000 to 223,000, a 52 percent gain.”

Nano Dimension has also completed its two most recent acquisitions, Markforged and Desktop Metal. However, the presentation accompanying the financial results states that “Markforged has its share of operational cost issues that must be addressed,” which the company is doing. Assaf Zipori, who has been chief financial officer of Markforged, was appointed as Nano Dimension’s new Chief Financial Officer on April 24, 2025

In contrast, the presentation points out that Desktop Metal has liabilities and liquidity needs it cannot currently meet, for which Nano Dimension has had to provide funds to cover this shortfall. Desktop Metal is now evaluating its strategic alternatives but the reality is that this acquisition was driven by the previous management team so the new management is not committed to it.

Nano Dimension also included preliminary figures for the first quarter of 2025. This shows revenues of US$ 14.4 million with US$ 840 million in cash, bank deposits and so on up to 31 March 2025.

The company is planning to host a strategic update in June 2025. In the meantime, you can find further details from nano-di.com.