Earlier this month Kodak posted its financial results for its second quarter ending 30 June 2024, which is a good opportunity to look at where the company is now, helped by an interview with the CEO, Jim Continenza, at Drupa this summer.

Firstly, the headline figures are not great, with a drop of $28 million from $295 million in Q2 2023 to $267 million for this last quarter. Consequently, gross profit was down $5 million to $58 million this year, against $63 million in Q2 2023. The net income according to Generally Accepted Accounting Practices fell $9 million to $26 million this year from $35 million last year.

Not surprisingly, Kodak’s press release seized on the one piece of good news, that the gross profit percentage was up 1% to 22% this year, suggesting some improvements in overall efficiency. However, this has to be set against a 45% fall in operational Earnings Before Interest, Taxes, Depreciation and Amortisation, which was down to $12 million this year against $22 million in 2023.

More worryingly, all of the damage has come from the Print division, which saw revenues fall from $215 million in 2023 to $186 million in Q2 2024. The Advanced Materials and Chemicals division recorded a slight gain, up $1 million to $73 million, while the Brand licensing held steady at $4 million.

see also

The webfed inkjet

press market in

India is taking off!

Some vendors might argue that customers paused investments in the run-up to Drupa, and there may some truth in that. But I think these figures should be seen in the context of a slowdown over the last three quarters for Kodak. The full year results for the last financial year ending 31 December 2023 were largely positive, with net earnings up from $26 million to $75 million although sales and revenues were both down.

However, last year’s Q4 figures revealed that revenues were down, from $305 million to $275 million, and although the costs were also down this translated into a slight drop in net earnings from $7 million to $5 million

This trend continued in this year’s Q1 results, with revenues down 10% from $278 million to $249 million and the operational EBITDA down from $9 million to $4 million though net earnings were a healthy $32 million this year, as against $33 million from Q1 last year.

When I met with Continenza at Drupa I asked him about the drop in Kodak’s revenues over the last couple of quarters, which he mainly attributed to restructuring. And as he pointed out, there have been some improvements in the company’s underlying efficiency, with steady improvements of one or two percent each quarter in the gross profit percentage.

Continenza says that in the past Kodak had multiple divisions and they were all pulling in different ways. He continued, “I had to step into the CEO role in 2019 because we were heading in the wrong direction. We had to figure out who we were. And I put the company back to where it should have been.”

Today Kodak is focussed on two main divisions, with the biggest one being Print and everything else falling under Advanced materials and Chemicals or AMC, which also includes some contract work that makes use of Kodak’s expertise in chemistry. He notes, “And part of that falls into print. There’s a lot of similarities between the two but they are very different customer bases.”

He adds, “We do nothing else. I got rid of everything else. I didn’t sell it, I just shut it down and tossed it out. And 30 other things we shouldn’t have been doing like crypto.”

He argues that when companies get into difficulties they tend to cut costs or raise prices, continuing, “I have been part of almost 35 company turnarounds. I see that when things get bad, they contract. But they never look at ways to make more money with their cash.” He continued, “Where we do not use services, it means the money has no value. So we invested in our internal systems, in IT and everything. Last year we did $160 million in operational efficiency which is because of that investment we made then. So I commit to my customers that when I raise prices I will cut costs.”

He said that Kodak has also worked to identify which customers were holding it back, saying, “We got rid of negative customers. If we can’t make money then they are not our partner. So we have been very selective with the revenue that we accepted and that’s what we focus on – smart revenue.”

This need to focus on the right customers is particularly acute when it comes to inkjet presses. No vendor wants the negative publicity, not to mention cost, of having to take back a press that’s not worked out for a customer. Equally, it can be a bit of a gamble for customers to be sure that they can build up the right mix and volume of work to justify the particular characteristics of a given inkjet press.

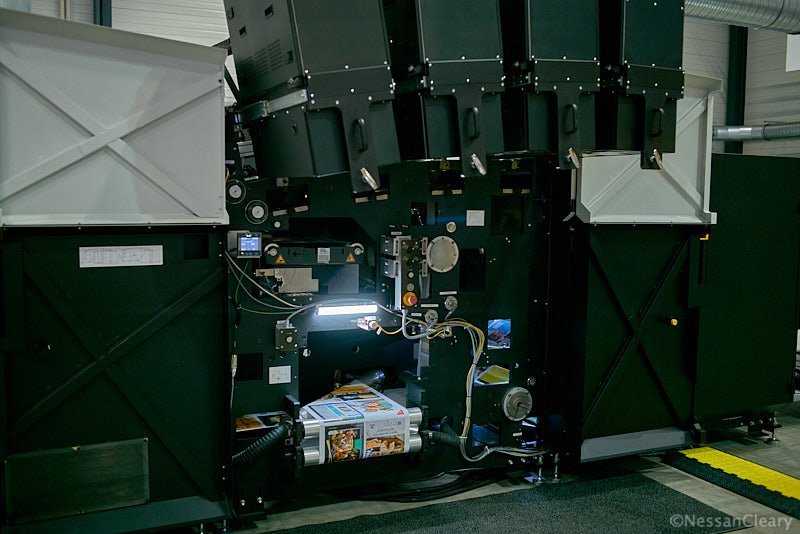

Photo Nessan Cleary

And Kodak does have an extremely interesting press in the shape of its brand new Ultra 520. This press, which is built on the company’s UltraStream continuous inkjet technology, dominated Kodak’s stand at this year’s Drupa. I’ve written about this press before but for Drupa Kodak showed off a new precoater for the Ultra 520 that’s been designed for use with its range of Optimax primers. These primers should enable the press to handle most paper substrates while optimizing the amount of ink required for those papers. The primers can be applied either inline or away from the press.

However, the press has had quite a slow roll-out since Kodak first unveiled this iteration of its CIJ technology at Drupa 2016. Continenza explained, “It’s a controlled introduction for the 520. We have made many improvements and now it’s ready. We will only sell this machine where there’s a large volume.”

At Drupa Kodak picked up orders for five of the Ultra 520 presses to an existing offset customer, to be delivered over three years. Separately, the SDV Group, based in Dresden, Germany, became the first European company to buy one of these presses. The company specialises in marketing with Sven Schmöle, CEO of SDV Group, explaining, “We will print a wide variety of personalized direct mail applications on the Prosper Ultra 520 and also use it for versioning jobs and short-run commercial work.”

Continenza says that the 520 is suitable for a broad range of work, noting, “Things that go on offset but need variable data. And we build it to run at high speed.” He says that it doesn’t compete with Kodak’s other inkjet press, the Prosper, adding, “Some people might have both. They are different applications and they don’t overlap.”

For now Kodak seems to be concentrating on commercial printing though the press should ultimately allow Kodak to challenge other markets as well. Continenza says, “We did a packaging machine with one company. We have other stuff in the works. More to come from packaging.” He adds, “We are not ready yet for packaging. We are focused right now on commercial print and less on others and I have no problem with that.”

It does make sense to start with the commercial print market, since Kodak has plenty of experience in this area plus a large customer base of offset printers using its Sonora plates. The Ultra 520 can handle a very high volume of work, but that doesn’t necessarily mean that there are lots of potential customers who have that volume. Hence Kodak’s smart revenue phrase, which essentially means vetting customers to be sure they do have the volume to justify investing in this press.

However, the packaging market should offer Kodak a far better opportunity as there are potentially much higher print volumes, and very few other inkjet presses able to satisfy that. So the question is really, can the Ultra 520 handle the wide range of materials that Kodak has talked about including flexible films? I suspect that Kodak is still working on the primers that would be necessary to enable that.

Analog to digital

Continenza also echoed a common theme that I heard from many senior managers at Drupa, that not only is there room for both digital and analog press technologies to survive but that each vendor wants to accommodate both approaches. Kodak’s stake in analog print is through its offset plate business and Continenza was adamant that Kodak would continue to invest in this area, telling me, “I plan to be the last person in plates and film and that’s why we are investing in a new Sonora. Offset presses probably will be around for a lot of years. We can compete with the plates even as the volume of these presses will go down.”

If anything, he sees some growth in this area through contract manufacturing, saying: “Motion picture film is growing. Consumer film has grown. But also we make film for other people. There’s a lot of people that made film over the last century. They couldn’t support having a massive factory and not the volume so you are better off having someone else make the film for you.”

To underscore this, Kodak also announced at Drupa the latest iteration of its Sonora processless plates, the Sonora Ultra. This was complemented by a new Magnus Q3600 Titan platesetter, which can handle plates up to 1600 x 2083 mm.

However, Kodak’s play for offset isn’t just about putting plates onto litho presses but also to install inkjet printheads on those presses to add a variable data capability. To this end Kodak is now also offering a new Prosper Print Bar, with different variants using either the Prosper Plus or Prosper S-series printheads. This offers 600dpi resolution at speeds ranging from 153mpm with the S5 heads up to 900mpm with the S30 heads.

Continenza told me, “I think there will be an evolution with more inline heads in offset presses.” He went on to note, “My real business is selling ink. We are putting the heads on offset presses. And we made special ink to solve problems. So we will continue to do the high speed heads which are quicker than anybody else’s. I won’t sell 10,000 of those heads but I sell to the big printers and get the volume ink sales.”

Outlook

The fundamental reason that Kodak’s results are down for the last couple of quarters is that the print division is not bringing in as much revenue as in previous quarters. The results do show slight gains in efficiency but that is not enough on its own. The new Sonora Ultra plates and the Prosper printbar will help but I doubt that consumable sales alone will really close the gap. Instead, Kodak needs to sell more inkjet presses and the new Ultra 520 should help with that. Hopefully the next few quarters will show a boost from Drupa but I suspect that the investors are going to have to hold their nerve for a while longer.

He explained, “I care about my investors. That’s why we work together. Last year we raised $450 million to fix the balance sheet. I don’t have to have a bank because we look after investors.” He added, “I’m the largest individual shareholder so I put millions of dollars in the company.”

And Kodak does have one other ace up its sleeve with a potential move into healthcare, which started during the pandemic. The company is currently converting an existing clean room to a Current Good Manufacturing Practices or cGMP facility that will be used to manufacture diagnostic test reagents. This should be certified by the end of 2024, with production expected to begin in Q2 2025.

As with any large multinational, Kodak also lobbies governments on their economic policies to create more favourable business conditions. He says that last year Kodak was instrumental in cutting tariffs in Germany to help its European customers while also arguing for more tariffs against Chinese imports to the US, noting, “The tariffs meant that people bought US. It will help our printers because the Chinese are taking printing jobs away from our printers and hopefully the tariffs will drive that back to our printers. We work with our customers to help them.”

He continues, “We only win when our customer wins. We can’t make money if we don’t help them win.” He adds, “Some customers have government incentives to invest and some don’t. But customers have learned that if they don’t invest they are not going to make it.

Continenza concluded, “We are not out of the woods. We know it’s a long journey but we are building a good foundation for the journey. We care about the long term value for the investors and the people who invest with us know that.”

You can find further details from kodak.com.

First posted on 30th August 2024 on the Printing and Manufacturing Journal www.nessancleary.co.uk.

Republished by permission.