As late as 2019, China imported almost 100 million m3 rwe (roundwood equivalents) of softwood logs and lumber to meet the growing demand for forest products, including paper and pulp, in the domestic market. Since then, wood consumption has declined, and the import of forest products has decreased to levels not seen in over a decade.

Wood Resources International, a global provider of wood fiber pricing, analytics and insights from ResourceWise, reports that China imported about 12 million m3 of logs and lumber (rwe) in the first quarter of 2023, nearly half its peak in the third quarter of 2020 and the second lowest quarterly imports in 10 years.

According to the World Bank, China’s economy took a big hit during the Covid epidemic, with the GDP growth falling to an estimated three percent in 2022, compared to a 9% average annual increase from 1978-2021. It is estimated that the economy will see a rebound to just over five percent growth in 2023.

It may be mentioned that wood supply is directly related to the paper industry. China is one of the largest paper and pulp producers in the world.

Wood used for pulp making can be classified into two main groups: Softwoods (coniferous trees, such as pine, fir, spruce and hemlock) and Hardwoods (deciduous trees, such as birch, aspen, eucalyptus, acacia and oak), a report in ABB International said.

The biggest difference between hardwood and softwood fibers is that the hardwood fiber is considerably shorter and thinner than the softwood fiber. Generally, hardwood contains more cellulose and hemi cellulose and less lignin than softwood, while softwood has a higher proportion of extractives, i.e. resin.

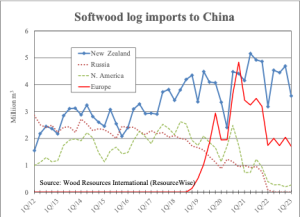

China’s dramatic reduction in log imports has predominantly been driven by the lack of supply from Russia following the country’s implementation of a log export ban in January 2022. Russia was the largest log supplier to China until 2012 when New Zealand surpassed it. Since then, Russia’s shipments have fallen consistently and were down to zero in 2022. With log supply from Russia, Australia, Canada, and the US plunging over the past five years, New Zealand and Europe have become the two major regions supplying China (see chart).

During the first four months of 2023, New Zealand’s market share of China’s total log imports was 58%, followed by Germany (14%), Poland (5%), the US (5%), Canada (4%), and Japan (4%). The outlook is for declining shipments from North America and Europe, eventually leaving New Zealand as the only remaining major log supplier.

Consequently, China will need to explore opportunities to increase lumber imports rather than logs to meet future wood demand, Wood Resources International says.

Log trade in the Baltic down

According to a separate report by Wood Resources International, log trade in the Baltic Sea region has declined. This is primarily for two reasons: Russia’s invasion of Ukraine, and because of investments in forest production capacity in the Baltic States.

The two largest log-trading regions in Europe are Central Europe (where Austria, Czech Republic, and Germany are the major importers) and Northern Europe (Finland and Sweden are the two log-importing countries). The most significant change in trade flow in Europe over the past few years has been the dramatic decline in log imports to the Nordic countries from Russia since the country invaded Ukraine in early 2022.

According to Wood Resources International, the total log import volume to Finland and Sweden was just over 8 million m3 last year compared to an average of almost 16 million m3 annually throughout the previous decade. In addition to the halt in log imports from Russia, there has also been a substantial decline in log exports from Estonia, Latvia, and Lithuania to the Nordic countries. Most of the reduction has been in softwood logs, while hardwood log shipments have been relatively stable, fluctuating between three and four million m3 annually.

Softwood log trade in the Baltic Sea region has declined steadily for the past five years. In the 3Q/18, the total softwood log imports to Finland and Sweden reached a 15-year peak at 2.5 million m3 for the quarter and have since trended downward to just over one million m3 in the 1Q/23 (see chart). Over the past year, trade flows to Sweden from neighboring Finland and Norway declined the most, shipments from Sweden to Finland and from Latvia to Sweden showed slight increases.

The tighter supply of pulplogs and strong pulp markets has pushed log prices upward over the past year. In the 1Q/23, y-o-y import prices for softwood and hardwood pulplog to Finland jumped 93% and 123%, respectively. Prices for imported softwood and hardwood pulplogs to Sweden were up 14% and 111%, respectively, during the same period. Pulplog import prices to Finland and Sweden were substantially higher than domestic prices in the 1Q/23, as reported in the new WoodMarket Price digital platform from ResourceWise.