In February 2018, the formidable Japanese press manufacturer acquired a majority stake in its Indian distributor’s offset press sales operations for an undisclosed consideration. The new joint venture between Insight Communications and Komori is called Komori India PL and headed by Hirofumi Hoshino as managing director. The new company held a press conference in Delhi on 20 April 2018, which was attended by senior executives from both partner organizations. The presence of Yoshiharu Komori, chairman and chief executive officer of Komori, attests to the importance of the Indian printing press market in the company’s future plans.

The new managing director of Komori India is a mechanical engineer who joined the company in 1977 and has been involved in both press design and manufacturing. A core member of Komori’s global sales and service, Hoshino has worked in Komori America and Komori Europe. At the press conference in Delhi, he spoke optimistically of Indian GDP growth to 2050, which is projected to establish the country as a major economic power. He also projected printing press sales that envision Asia and India as major markets.

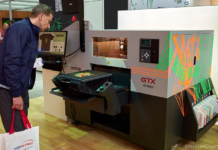

Apart from projecting the importance of the Indian print and press market, Hoshino spoke about some of the benefits of the company’s direct presence. Essentially, these are better communication and responsiveness to printers and the direct presence of senior Japanese engineering and training personnel. The implication is that the increased bandwidth of the company in the Indian market will also mean expansion of its sales of software, cloud based data collection and services, as well sales of its digital presses, specialty application presses and equipment and consumables.

Hirofumi explained Komori aims to provide, “A customercentric consulting approach including technical reviews of sales specifications in which our customer’s expections are exceeded. The India office will also be the hub for Bangladesh and East Africa and in the coming financial year we hope to achieve revenues of Rs. 200 crore (approximately US$ 30 million).”