Messe Dusseldorf’s 4th ‘drupa Global Trends’ report is available now. The survey is based on talks with nearly 1200 participants who visited drupa in May of 2016 although they were interviewed later. It is claimed that the survey represents a good cross-section from all the main market sectors and regions – 839 printers participated, with 525 from Europe and 314 from the rest of the world. The 331 responding suppliers included 220 from Europe with the rest from all the other regions. Printfuture (UK) and Wissler & Partner (Switzerland) assisted Messe Düsseldorf in conducting and authoring the report. Published below are excerpts from the executive summary. All graphics are a copyright of Messe Düsseldorf/C Tillmann.

Optimism conquers reality

In global terms, 42% of printers described their business as in a ‘good’ economic state, while 11% described it as ‘poor.’ As always the forecast for next year is somewhat more optimistic than the reality the following year while in some cases the difference is striking, such as Africa, which reported a net decline in confidence, the first time for any region since this report series started in 2013.

Print price and margins fall everywhere except in South and Central America

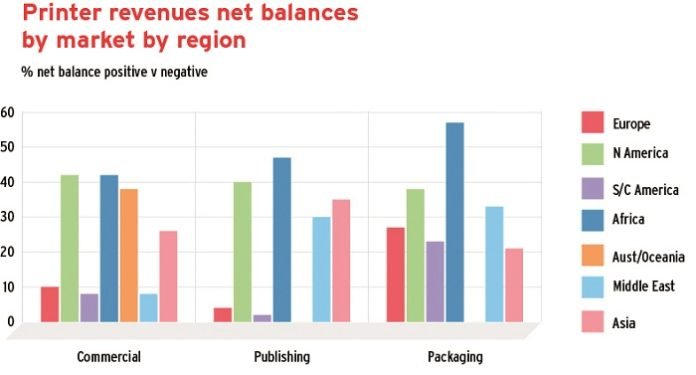

Printers globally report continuing falls in prices, which are compensated for by increasing utilization and hence raising overall revenues at a cost of falling margins. South/Central America and Africa reported net positive price increases whilst the Middle East reported severe price and margin falls. Similarly, while publishing printers in North America show falls in revenues, prices and utilization, in South/Central America and Africa rises were reported in all three measures.

Digital cut sheet volumes up 25% – webfed digital up 11% – sheetfed offset and flexo up 8%

Fourteen out of sixteen technologies listed scored a 10% or above penetration in at least one of the market sectors. Overall digital toner cutsheet color presses led by a wide margin in terms of the positive net balance of print volumes in 2016 at +25% followed by digital inkjet rollfed color at +11%. The picture is more complex when you drill down into the market sectors, where for example there is 8% growth overall in sheetfed offset thanks largely to packaging and publishing markets and an 8% growth overall in flexo due to packaging and functional markets.