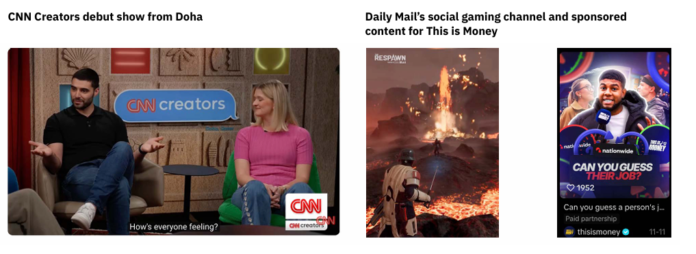

There is this story about The Washington Post’s award-winning TikTok guy, Dave Jorgenson, who worked at the company for eight years before deciding to set up his own independent venture. Almost overnight, the reach of the Post’s ‘Universe’ YouTube channel, which earlier hosted his videos, crumbled. Jorgenson’s new enterprise, LNI (Local News International), overshot the Post’s channel, according to Reuters’ new report, quoting data from digital analytics platform Rival IQ.

According to Reuters’ Journalism and Technology Trends and Predictions 2026, human creators and influencers like Dave Jorgenson are reshaping the landscape with personality-led journalism that challenges the authority and relevance of traditional media outlets.

The creator economy, along with generative artificial intelligence (AI), is likely to further disrupt the news industry and intensify pressure on established news organizations in 2026, according to a Reuters industry survey by Nic Newman, which draws from a strategic sample of 280 digital leaders across 51 countries and territories. Apart from these two defining factors, the report documents trends shaping the year ahead, as perceived by media leaders across the world.

Mixed bag for journalism & declining confidence

Senior media executives across the world have expressed low confidence in journalism as a whole, but at the same time, remain positive about their own news organizations. This year’s survey shows that more than a third (38%) of editors, CEOs, and digital executives are confident about journalism’s prospects in 2026 — down 22 percentage points from four years ago. Concerns center on politically motivated attacks on the press, the loss of USAID funding that once supported ‘independent’ media, and significant traffic declines for many online news outlets.

The leaders are concerned about how traditional media is losing touch with sections of society, including younger people and other groups less interested in legacy news media. They claim to be worried that increased reliance on social media – including non-journalist creators and influencers – could lead these groups to be more vulnerable to lower-quality or unreliable information.

Despite their doubts about journalism as a whole, about half (53%) are, nevertheless, confident about their own business prospects, mirroring last year’s figure. Subscription-based publishers with strong direct traffic foresee long-term sustainability, while those reliant on advertising or print remain anxious about revenue declines and AI-driven search disruptions.

Search traffic mayhem

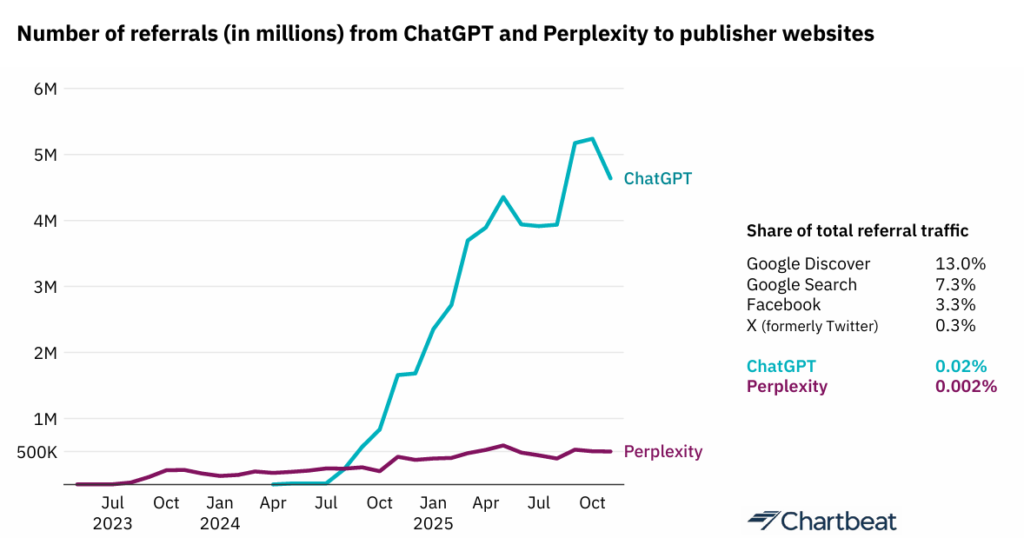

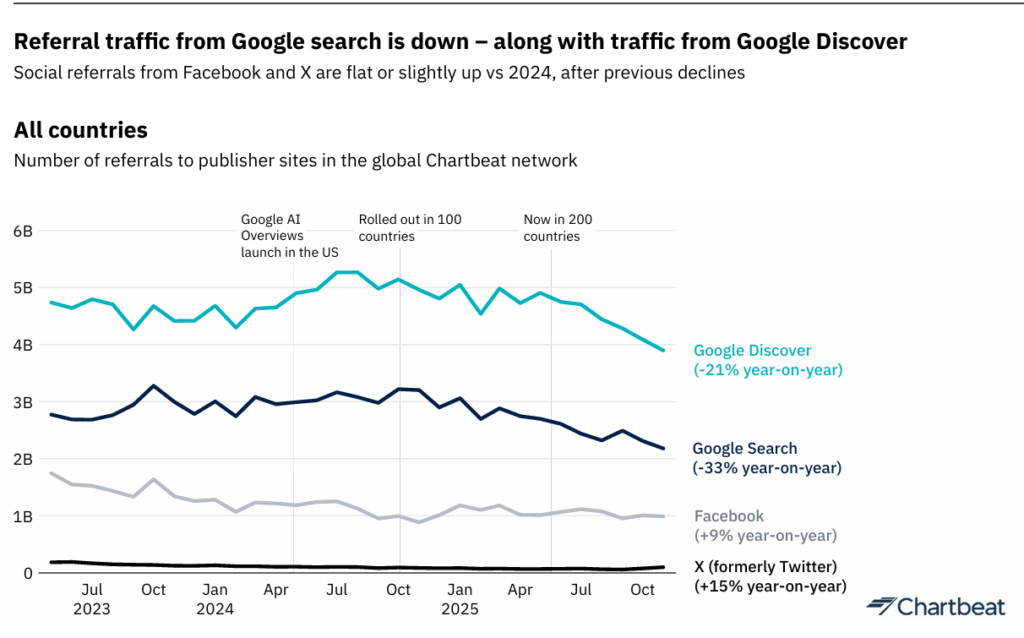

Publishers expect search-driven traffic to fall by over 40% in the next three years—not quite ‘Google Zero,’ but still a significant shift. Data from Chartbeat already shows a dip in Google referrals, particularly for lifestyle publishers hit by AI Overviews. This follows steep traffic losses from Facebook (-43%) and X (-46%) over the past three years.

To adapt, publishers plan to prioritize original investigations and field reporting (+91), contextual analysis (+82), and human-centered stories (+72). They plan to scale back service journalism (-42), evergreen content (-32), and general news (-38) much of which they expect to be commoditized by AI chatbots. Investment is set to rise in video (+79), including ‘watch tabs,’ and in audio formats such as podcasts (+71), with a slight pullback in text output.

“We are committing our resources to meaningful, deep-dive journalism and analysis and moving away from broad news coverage,” says Ritu Kapur, co-founder and managing director of The Quint in India, one of the media leaders quoted in the report.

Off-platform, YouTube tops this year’s focus list with a strong net score of +74, followed by TikTok (+56) and Instagram (+41). Publishers are also exploring distribution through AI platforms (+61) such as OpenAI’s ChatGPT, Google’s Gemini, and Perplexity. Google Discover remains a valuable (+19) though volatile, traffic source, while some publishers are testing newsletter platforms like Substack (+8). Efforts on traditional SEO (-25) Facebook (-23) and X (-52) will decline further.

Rise of AI-linked revenue models

After forecasting the rise of ‘agentic AI’ last year, publishers now expect tangible effects from these technologies. Some predict that bots could soon outnumber human readers, as tools like Huxe and OpenAI’s Pulse deliver personalized briefings at scale. Three-quarters (75%) of respondents expect these agentic tools to have a ‘large’ or ‘very large’ impact on the industry soon.

Despite the disruption, AI also presents new revenue opportunities. Around one-fifth (20%) of publishers—mainly high-end outlets—anticipate significant income from licensing or advertising partnerships within chatbots. Nearly half (49%) expect only minor returns, while another fifth (20%)—mostly local or public publishers—do not expect any AI-related revenue.

Subscription and membership models remain the top revenue focus for 76% of publishers, ahead of display (68%) and native advertising (64%). Both online and in-person events (54%) are gaining importance as diversification tools. Reliance on philanthropic or foundation funding (18%) has dipped following cuts in media aid budgets, particularly in the U.S.

Use of AI in news organizations continues to grow across the board. Back-end automation is considered ‘important’ by 97% of publishers, many of whom have integrated pilot tools into CMS workflows. AI in newsgathering (82%) and in coding or product development (81%) is also gaining traction.

While 44% of respondents report ‘promising’ results from AI initiatives, a similar share (42%) see only ‘limited’ outcomes. Two-thirds (67%) have yet to realize job savings, though 16% report slight staff reductions and 9% have added new AI-related roles. The report also talks about the explosion of low-quality AI-automated content, including so-called ‘pink slime’ sites, with platforms struggling to distinguish these from legitimate news.

The creator economy is a surging reality

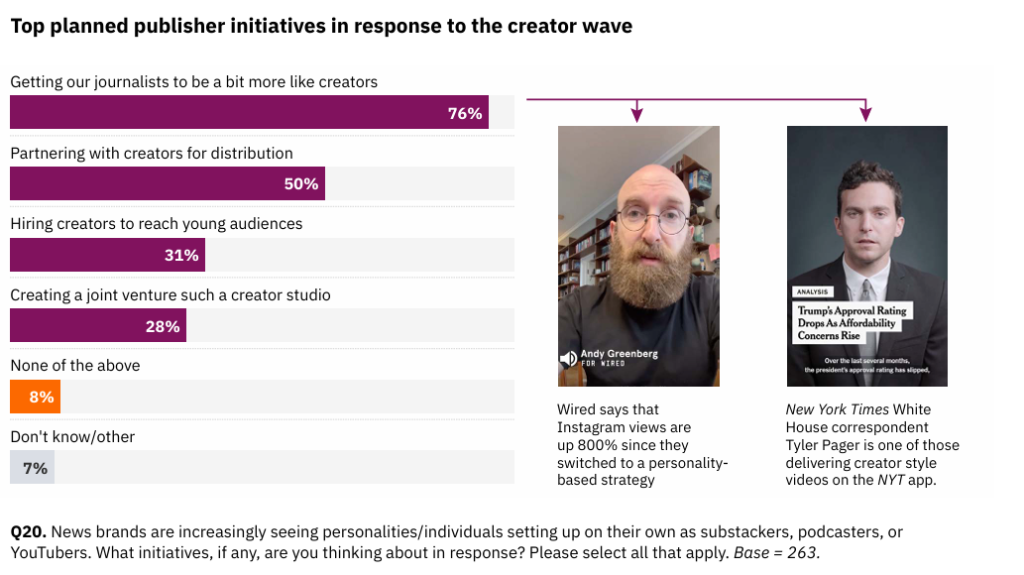

The rise of news creators and influencers poses a twofold challenge: 70% of publishers fear they’re diverting attention from traditional outlets, and 39% worry about losing top editorial talent to more lucrative creator ecosystems.

To compete, three-quarters (76%) of publishers plan to encourage staff to adopt a creator mindset this year. Half (50%) will partner with creators for distribution, one-third (31%) will hire them for roles such as social media management, and 28% aim to establish creator studios or joint ventures. “The creator economy will continue to surge, fuelled by investments from video platforms and streamers. At the top end, creators will look more like Hollywood moguls with big budgets and their own studio complexes,” the report says.

Distinguishing good creators from bad ones, however, will get tougher. “In a world where anyone can produce professional-looking content, it is getting harder to define what marks out journalism. This is a challenge for media companies but also for journalistically minded creators who want to be taken seriously,” the report says.

Summing up, the survey says news executives acknowledge upcoming challenges but remain determined. While the industry may shrink, success will favor organizations that clearly define their purpose, deliver value to targeted audiences, and stay adaptable—aligning strong values with openness to change.