The recent ITMA Asia + CITME show in Singapore built on the city state’s reputation as the gateway to Southeast Asia, perhaps a fitting metaphor since the value for textiles – as with so many consumer items – flows mainly from demand in the more affluent West to manufacturing in the East.

And yet many exhibitors seemed somewhat hesitant in their commitment to the show, with only a handful of Western digital print vendors making the journey and most of those having relatively small stands. Then again, my interest is mainly digital print, which is only a very small part of the wider textile business that the show covers. Nonetheless, the vendors are hesitant to invest heavily because they are unsure if the Singapore show will become an established fixture.

Perhaps, the clue to this lies in the show’s convoluted name. The ITMA part is owned by CEMATEX, the European Committee of Textile Machinery Manufacturers, which holds its main trade fair every four years in Europe, where most of the revenues in the textile business are generated and where most of the brand customers are based. But with China having emerged as a major manufacturing base, CEMATEX made the strategic decision in 2008 to partner with the Chinese Textile Machinery Association, which holds its CITME trade fairs every two years in China. However, many Western vendors have complained that it’s harder for them in China to compete directly against the many Chinese companies on their home ground.

Singapore’s main attraction is as a central location for all the Southeast asian countries, including India, Pakistan, Bangladesh, Indonesia, Thailand, and Vietnam. Many of these countries have their own uneasy history with China, but Singapore offers a neutral base free of any fraught international politics. Micol Gamba, product marketing director for EFI Reggiani, says that Singapore has brought in many visitors from across the Southeast region, noting, “We see that it’s providing a wide breadth of customers and we are glad about that.”

Jurgen Westerhoff, product manager for SPG Prints, also points out that for customers from countries such as Turkey and Pakistan, it’s easier to get a visa for Singapore than for China. Despite – or perhaps because of – its strict policing, it’s a remarkably easy-going place with a very international cosmopolitan feel, even with the cloying heat outdoors and aggressive air con indoors.

It’s always hard to tell just how serious the Chinese vendors are about international sales. Many European and American journalists are under the impression that the Chinese vendors don’t have the distribution capability to expand into the West, but I think that it’s more a question of mindset, and that varies from one market sector to the next. In wide-format printing, for example, several Chinese vendors are clearly making inroads into Europe with sales backed up by service and distribution. However, the Chinese vendors in general appear to be further behind in labels and packaging, and even less so in textiles.

Then again, many of those Chinese vendors are already embedded into other regions such as India and Pakistan, where there is more opportunity in textile production. For this reason, I would have expected to see a greater number of Chinese players in Singapore. Nonetheless, there were a number of Chinese vendors at the show. I’ve already written about Atexco, which brought the only single-pass textile printer to Singapore.

Then there is Haiyin Digital Technology, also known as Hiink Digital, which is based in Zhejiang Province. This company has developed the Kun single-pass printer, but for the show chose to bring a 1:5 scale model. It’s a single-pass printer using Fujifilm Dimatix Samba printheads, giving it 1200 x 1200 dpi resolution.

It’s available in two sizes, the SP1600 at 1.55m wide, and the SP1800 at 1.72m. The larger model has 40 heads per printbar. The samples are excellent, including detailed patterns with fine lines. Bahattin Haziness, who is from the Turkish distribution company Future Digital, says that it can run at up to 80mpm, but that the speed depends on the ink coverage and print mode, and that 60mpm might be a more realistic production speed.

The basic model uses four colours, but it can be configured for up to eight colors. It takes reactive, acid, pigment, and disperse inks, printing CMYK plus orange, blue, and red. There’s a pretreatment unit at the front that flood-coats the fabric.

Haziness says that the company has so far installed 55 print systems in China – though the Kun only accounts for around 13 of these according to the company’s own website – and is now looking to expand to other countries. It’s not cheap at around $2 million.

Another big theme is the continuing development of pigment ink. Gamba says that although reactive inks account for 50 percent of all installed machines in the industrial textile print market, pigment ink is starting to make inroads into home textile, “and we are seeing some adoption in fashion.”

She says that a lot of the conversations revolve around the cost of the ink or the cost of the printer, adding “but we are educating customers in what is the real value of pigment is and the cost of ownership.” In this vein, EFI Reggiani announced a new Titan printer, which uses the Eco Terra pigment ink, which I’ve already covered. ColorJet also showed off a new home furnishing printer, the FabJet Pro, which will mainly be used with pigment ink, and Atexco showed its EcoPrint, which works with pigment ink.

SPG Prints demonstrated an updated version of its Jasmine textile printer. The Jasmine is a direct-to-fabric inkjet printer. It’s available in 1.8, 2.6, and 3.2m widths. It will take up to eight colours, with a choice of reactive, acid, pigment, or disperse inks. There had been a choice of 16 or 32 printheads, but the main change to the Jasmin 1.2 version is the addition of more printheads, now up to 64.

The heads in question are the Kyocera KJ4B EX600 heads, which are the latest generation with the monolithic actuator, and which I’ve explained in more detail here. However, SPG has chosen to use the non-recirculating version, on the assumption that the main benefits of recirculation are to control the temperature around the printhead, and to prevent the ink drying out on the nozzle plate. SPG Prints has built its own temperature control system to heat the ink to the required viscosity level, together with cooling to ensure the system does not overheat, which would otherwise be an issue in some warmer climates. Westerhoff says, “In our opinion, it’s less risky to cool the heads from outside.” He adds, “Some people claim that you get foaming inside the head with a pigment ink with recirculation.”

As regards reliability, he says, “In certain markets like India and Pakistan, the customers are running 24/7, so the recirculation isn’t needed because you don’t have any drying in the heads.” In terms of resolution, he says that the market is split, and that some customers prefer 600dpi and choose the Jasmine, while others prefer 1200 dpi, which SPG caters to with its Magnolia printer. He says that SPG has quite a few installations with customers printing high-quality work, mainly for fashion, at 1200 dpi “but mostly it’s not needed.”

Epson showed a broad range of its printers, including a new 1.9m wide dye sublimation printer, the SureColor F11030/H, which builds on an earlier F10030/H, but with added support for jumbo rolls. Desmond Gay, regional manager for Epson Singapore, says, “When customers print a lot, they require a large roll of media to minimise the frequency of changing the rolls, so the new model allows us to do that.” Otherwis,e the specifications remain the same, with four i3200 PrecisionCore printheads producing around 150sqm/hr.

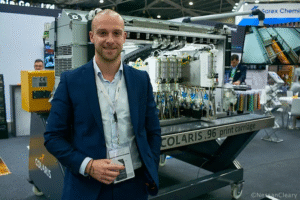

The Austrian vendor Zimmer took a stand at the show. Zimmer does have some digital textile printing solutions, but opted to only show its Colaris print unit. The company has also developed an interesting curing unit that is quite compact and can be mounted in line with other equipment. It works by heating up a large bath to generate steam, with sales manager Mario Calis saying that it can be run with gas or electricity but uses less energy than other alternatives. So far, there are three installations which Calis says have given Zimmer confidence in its overall reliability.

Besides printer manufacturers, there were also several component suppliers. For these companies, their market is to OEMs rather than to end customers. So for companies such as Meteor Inkjet, which mainly sells printhead electronics, and InEdit, which supplies textile RIPs, taking a stand at the show was not so much about marketing, as they are already in touch with their OEM customers, but more about having a place to meet with those customers.

Finally, there is one question that lurks over the whole of the digital print business, but which was not really touched on in Singapore. What is the point of digitally printing textiles? There are two answers to this from a European perspective. The first is to cope with short runs, but as Westerhoff points out, the textile industry is very conservative: “It’s less of a print industry and more of a production industry. You can lower inventory and print on demand, but we are not really seeing that in textiles that much. So printers are replacing older machines with digital, but still following the same inventory scale as they have always been doing.”

And then there is the Western dream of reshoring – bringing back the domestic manufacturing industries that the West gave up so easily in the pursuit of wealth and free market economics. But as Westerhoff says, “We have seen some reshoring to Europe, but it’s proving to be difficult. Most of the investment is still being made in the traditional textile countries like India and Pakistan, and a very strong China.” He says that much of this is because of the growth of online platforms where customers are buying directly from overseas manufacturers like Shein and Temu, who are picking up most of the short-run work and bypassing the traditional producers.

The next ITMA Asia + CITME outing will take place in Shanghai in November 2026. This will be followed by the full European ITMA show in September 2027 in Hanover, Germany. It’s also worth noting that ITMA and CITME are not the only textile shows. Indeed, November will also see the Asia-Pacific Textile and Apparel Supply Chain Expo & Summit – better known as APTEXPO 2025 – at the same Singapore Expo venue.