UK headquartered Xaar’s recent results for its last full year, ended 31 December 2024, show a company experiencing some ups and downs. This starts with revenue of £61.4 million, which was down 13% from £70.2 million in 2023.

Xaar has mainly attributed this to a 27% drop in revenue at its Engineered Print Systems subsidiary, based in the US. This has let to a gross profit for the group overall of £22.22 million and an operating loss of £11.06 million. This is somewhat worse than the previous year’s operating loss of £2.24 million. The final pre-tax result for 2024 was a loss of £11.4 million, a significant decline from the loss of £2.7 million in 2023.

Xaar has excluded a number of further items from its final pre-tax results because they are one-offs. These include fair value losses on financial assets of £5.6 million due to an expected reduction in third-party revenues related to the sale of the Xaar 3D subsidiary. There were also costs relating to the rationalisation of the Digital Imaging business, plus £1.0 million in redundancy costs and share-based payment charges of £1.1 million.

Not surprisingly, Xaar has chosen to focus on the gross profit margin, which is a healthy 36%, though down from the 38% of 2023. However, the net cash flow of £1.6 million is much better than the negative figure of £1.4 million from 2023.

Global ceramic tile market in decline

Xaar is still plagued by its over exposure to the ceramics market, which peaked around a decade ago. In 2023 Xaar recorded revenue of £15.5 million from the ceramic market but this halved in 2024 to to £7.5 million. This is mainly due to a significant decline in the Chinese construction industry, which continues to cause weakness in the global ceramics tile market. Xaar has tried to counter this by expanding into other areas, notably Direct-to-Shape, Advanced Manufacturing and Textiles. The company has had some success, such as coding and marking, which was up 18% from £11.2 million to £13.2 million. Xaar also saw 400% growth in its revenue for packaging and textiles, from £0.4 million to £2 million. This last suggests that OEMs are now starting to make use of the Aquinox printhead for water-based inks.

The packaging market, which also includes textiles as well as coding and marking, grew from £11.6 million to £15.2 million in revenue. The industrial sector continues to be Xaar’s biggest focus, but fell from £55 million in 2023 to £42.7 million in 2024, which still dwarfed the graphic arts market, which was more or less stable with revenues of £3.5 million, down from £3.6 million in 2023.

Xaar’s main business is still the manufacture and sale of inkjet printheads, which accounts for 55% of revenues, with the main business strategy being to sell more printheads. This is followed by product print systems at 26% which is mostly the EPS subsidiary, digital imaging at 15%, which is mostly the former FFEI, and ink supply systems at 4%, mainly handled by the Megnajet subsidiary.

FFEI’s old manufacturing plant in Hemel Hempstead has now been shut down and its printbar manufacturing moved to Xaar’s base in Huntingdon. FFEI’s Life Sciences division was sold off was sold in 2024 and the FFEI name has now disappeared. Also in 2024, Xaar paid out the final deferred consideration of £1,733,000 relating to the 2021 acquisition of FFEI. Xaar also settled the deferred payments of £200,000 each relating to its 2022 acquisitions of Megnajet and of Technomation.

Much of the turbulence that Xaar has experienced in recent years appears to be because it is overly-reliant on large orders from single customers. This has caused the sudden drop in revenue at EPS, because it had completed a multi-year, multi-unit order for one customer but then failed to find new customers. Equally, the Megnajet subsidiary saw 7% growth thanks to one customer who had halted orders in 2023 whilst restocking.

Interestingly, Xaar has refocused its R&D from developing new printheads to helping OEM companies integrate its technology into their machines. This includes developing a complete turnkey solution for M&R in the textiles market. I think its worth noting that other printhead vendors have typically got around this problem by simply acquiring a specialist company with the skills to help OEMs integrate heads into print solutions, and to provide sales and service support. This would avoid the risk of compromising R&D investment, especially as Xaar also needs to improve print resolution to address some markets such as packaging and labels where 1200 dpi is becoming more common.

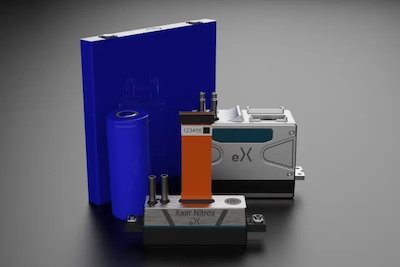

The 2024 report includes a list of market opportunities that highlights how inkjet technology is increasingly being used for industrial manufacturing. Xaar is mainly targeting applications that require high viscosity fluids in order to capitalise on its technology advantages in that area. This includes the switch from film to coatings in the production of EV batteries, for which Xaar has developed two specific printhead variants, the Xaar eX and Nitrox eX. Xaar estimates this market could be worth £260 million.

Similarly, Xaar is hoping to convince car makers to switch from spray painting to jetting and is helping Axalta to create a digital paint machine, the NextJet. It’s worth noting that Archipelago is also targeting the coating market.

Despite selling off the Xaar 3D subsidiary, the company is still interested in the desktop 3D printer market. One customer, Flashforge, has developed a full color 3D printer that should deliver later this year, and is also developing a 3D wax printer that can be used in markets like jewellery production.

Xaar’s main market is still the US. The Americas delivered £27.7 million revenue, down from £30.2 million in 2023. The European market was worth £24 million, down from £27.8 million the previous year, while the Asian market fell from £12.2 million in 2023 to £9.7 million in 2024. Nonetheless, in my opinion, Xaar is too exposed to the Chinese market, which includes both the ceramics and EV battery applications. This is bound to lead to further complications throughout 2025 due to the US-led trade war that is now playing out.

Xaar’s main strategy is to develop brand new markets for inkjet adoption. This follows the unprecedented success that Xaar had with the ceramics market, though in that case the market effectively converted itself to digital. But the industrial markets that Xaar is now targeting don’t themselves see inkjet as the obvious solution and so Xaar is having to do the work upfront to build a path to digitization. That has involved developing turnkey solutions, which is giving Xaar a foothold in these markets. But it could prove to be a risky strategy because of the high likelihood that other printhead vendors will later jump into the market and undercut Xaar, as happened in the ceramics market.

More to the point it takes a lot of money, which Xaar does not have, forcing the company to divert R&D resources into developing these turnkey solutions. And it takes time, which is reflected in the 2024 figures. But if Xaar can develop these new markets, then it should see some benefits, hopefully in the 2025 results. In the meantime, you can find more details from xaar.com.

First published by the Printing and Manufacturing Journal on 25th April 2025 and republished by permission.