Much has been said and debated about the future of print media in the past few years, especially after the Covid-19 pandemic and the subsequent lockdown changed the consumption patterns and reading habits of consumers from physical to digital. Print media, especially newspapers, have taken a severe beating both in terms of circulation and advertising revenue in the past few years.

Adex is largely shifting to digital – which is making a large sent in the share of traditional media such as print and TV. Digital is the fastest growing segment today, taking the lion’s share of the adex pie and with the highest growth rate, as suggested by the latest reports released by media agencies.

Amid the digital onslaught, however, print has not only managed to keep its head its head out of the water and grab a life jacket, it has also gathered steam to stay in the race, the reports suggest. The quarterly and nine-month reports of a few top newspapers also show a positive trend in advertising revenue, albeit with caution.

Pitch Madison report shows a positive trend

A year ago, the Pitch Madison Advertising Report for 2024 had forecast that print in India would grow at 7% in 2024 against an expected degrowth in print of -4% globally. It also said print adex would cross Rs 20,000 crore in 2024 and surpass the pre-Covid 2019 figures.

A year later, their 2025 report says print, the second largest traditional medium, has once again shown resilience by registering a growth of 5%, if not 7%, and crossing the Rs 20,000-crore mark for the first time post-Covid as expected – reaching Rs 20,272 crore. In 2024, and the year before, print contributed 19% of the overall adex. Digital adex in 2024, on the other hand, was Rs 45,292 crore with a 42% share and a 14% growth rate.

But there is a catch. In 2019, print had an adex of Rs 20,045 crore, a little more than 2024, at a growth rate of 3% but with a share of 30% of the pie. Print’s share till the year 2019 was always more than 30%. In comparison, digital adex in 2019 was Rs 15,467 crore with a 23% share and a 32% growth rate.

Print was slowing down even before the Covid-19 pandemic. However, the visible and steep decline of print began in 2020, when the circulation of newspapers and magazines reached near zero across India, barring Kerala, where a very well-oiled newspaper distribution model and support from the government helped the industry stay afloat. Print in 2014 was at Rs 15,274 crore (41% share of total adex).

In 2020, the pandemic year, print adex fell to Rs 11,925 crore, a -41% fall as circulation collapsed. The market share fell to 22% amid the rise in digital. In 2021, when India started opening up, adex rose to Rs 16,595 crore at 39% over the anemic previous year, but the market share stuck at 22%.

In 2022, print’s adex rose to Rs 18,470 crore but the growth rate fell to 11%, and the market share remained at 22%. In 2023, while the absolute print adex rose to Rs 19,250 crore, its market share fell to 19% with the growth rate declining to a low of 4%.

“The fact that print adex grew last year by a rate of 5% is indeed worthy, suggesting that advertisers are rediscovering value in the medium, particularly its strength in delivering localized, high-trust advertising experiences,” the report says. Print’s global share of adex is only 3%, compared to India’s share of 19%. Germany is the only other country with a print share of 19%.

In terms of volume, print displayed no growth during the year. Q1 witnessed a 16% rise in volume, but Q2, Q3 and Q4 saw a decline of -6%, -9% and -1%, respectively. Q4 volumes for 2024 and 2023 were similar, signaling stability during festival time.

The flat to degrowth of volume across most languages, the report says, stands in stark contrast to the 5% revenue growth in 2024, indicating higher ad rates and premium pricing, especially in English and Marathi. “Hindi and English dailies contributed 64% of the total print volume in 2024, aligning with their significant revenue. A 4% volume growth in English publications supported revenue gains as English publications usually command higher ad rates. Growth in Marathi volumes of 5% and stability in Kannada and Tamil reflect a robust regional demand. On the other hand, there were declines in Telugu (-10%) and Malayalam (-8%), signaling weak market conditions in those regions.”

The primary drivers were auto, FMCG, education and real estate – contributing significantly to the ad pie. The eCommerce category shows a decline of 14%.

Projections for coming years

In 2025, the report says print adex will continue its upward trajectory, with a 7% growth and reaching almost Rs 22,000 crore. This projected 7% growth is despite the absence of major events such as the general elections, which significantly contributed to print adex in 2024.

However, print’s overall share in the total adex will gradually decline from a 19% in 2024 to 18% in 2025. In comparison, the global print adex, according to WARC projections, is expected to experience a decline of 7%. “This reduction reflects the broader trend of digital media’s increasing dominance in the advertising space.”

In absolute terms, the Indian advertising market encompassing print, television, digital, radio, OOH and cinema crossed Rs 1 lakh crore and was valued at Rs 1,08,000 crore in 2024, adding additional revenue of Rs. 8,942 crore, says the report.

In 2023, India’s adex closed just a little short of Rs 1 lakh crore at Rs 99,038 crore. Pitch Madison’s growth forecast for 2025 remains bullish compared to 2024, with an expected increase of 11% with Indian adex projected to reach Rs 1.2 lakh crore,

Different views: Not all on the same page

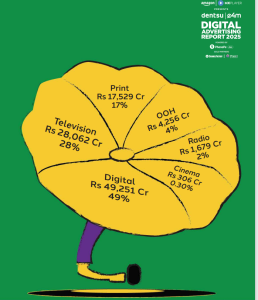

Two other different reports project a slightly different picture. The dentsu-e4m advertising report 2025 says that by the end of 2024, digital media accounted for the largest share of advertising spend at 49% (Rs 49,251 crore), followed by television at 28% (Rs 28,062 crore).

According to the dentsu-e4m report, print media’s share stood at 17% with Rs 17,529 crore, which is less than Pitch Madison’s claims. dentsu puts the overall adex numbers at Rs 1,01,084 crore in 2024 and forecasts it to reach Rs 1,07,664 crore in 2025 at a CAGR of 6.87%.

Digital is expected to climb from Rs 49,251 crore in 2024 to Rs 59,200 crore in 2025. By 2026, digital media will contribute 55% of India’s total advertising spend in 2025 and 61% in 2026, dentsu projects. Print’s share will come down from 17% in 2024 to 15% in 2025 and 13% in 2026, slightly less optimistic than the Pitch Madison report.

Group M is more bullish about the overall Indian adex scene but doesn’t put print media on a high pedestal. It projects the overall adex to grow at 7% to Rs 1,64,137 crore from Rs 1,54,137 crore in 2024. Print ad ex, however, it says will grow at 4% to reach Rs 15,947 crore from Rs 15,250 crore in 2024. Print’s share of the adex pie is projected at 10% in 2025 compared to digital’s 60% in the year.

Positive but fingers crossed

The recent quarterly results of a few top Hindi and English newspapers (Q3FY25), which we have already written about, also suggest a positive picture both in terms of overall as well as advertisement revenue this financial year. For example, in the print segment, HT Media saw an increase in ad revenue on a Y-o-Y basis across key commercial categories. Dainik Jagran also reported a slight Y-oY increase in ad revenue in Q3FY25. The DB Group says it delivered ad revenue CAGR growth of 20% in the last three-year period from Rs 1,008.4 crore in FY21 to Rs 1,752.4 crore in FY24. Malayala Manorana has also reported a Y-o-Y rise in overall revenue and profits though it does not give a breakdown of circulation and ad revenue.

One has to remember, however, that these are mostly bigger newspaper groups with wide reach and, hence, and would be in a better position to recover. The story could be, however, different, for smaller newspapers will low circulation. Recently, one of Nagaland’s prominent dailies, The Nagaland Page, shut operations after 25 years because of financial constraints.

Many major big and small newspapers were also forced to close editions or cut the number of pages to cut corners. Newspapers are also diversifying from legacy printing into other media channels and also contemplating re-energizing their production assets and moving to educational products, book printing, and even packaging.

In November 2024, Indian Printer and Publisher had a look at the financial results of 35 major newspaper groups, where we reported how ad revenues were perhaps going to some of the major newsgroups at very low rates and cannibalizing the revenues of some of the smaller groups.

Although the recent projections and financial results look positive for the industry that has been written off by many soothsayers, there is no denying that overall growth has been flat and marginal. Only time will tell how much steam is left in print media to survive in an increasingly digital world.