IppStar’s update on page 22 of Indian Printer & Publisher’s December issue and website covers 35 Indian newsgroups‘ revenue and profit figures up to FY 2022-23. Our sample cohort of 35 newspaper groups represents approximately 85 to 88% of the entire news industry revenue of Rs 25,300 crore that year. While this was a considerable increase compared to the previous year, the Indian print industry had relatively low growth rates, thanks to the success of more digital media in the country.

While our updated survey figures reflect the continued recovery of the news media print industry, figures for some of this cohort have become available for the FY 23-24 year. This data continues to show growth and the improvement is visible in our stories on the Q2 FY25 results of the DB Holdings and HT Media Group. Significantly, this growth is not just based on cutting circulations and pagination, which have again started to stabilize and even increase in a few cases, but overall cost efficiencies. There has also been some improvement in the pricing of subscriptions and advertising.

We can see that the consumption of raw materials has increased in several cases and also declined in some over the past two years, partly aided by newsprint prices that were benign and continue to be soft in the current financial year (FY 24-25).

Thus one of the major cost efficiencies of the industry seems to have been on the cost of human resources and news gathering. Reliance on stringers for district news and pages, together with various outsourcing schemes, are increasingly being used for news gathering and editorial functions. Employee and benefit expenses in the recent annual and quarterly reports are generally similar to previous years, but in some cases have declined, a reflection of further cost cutting.

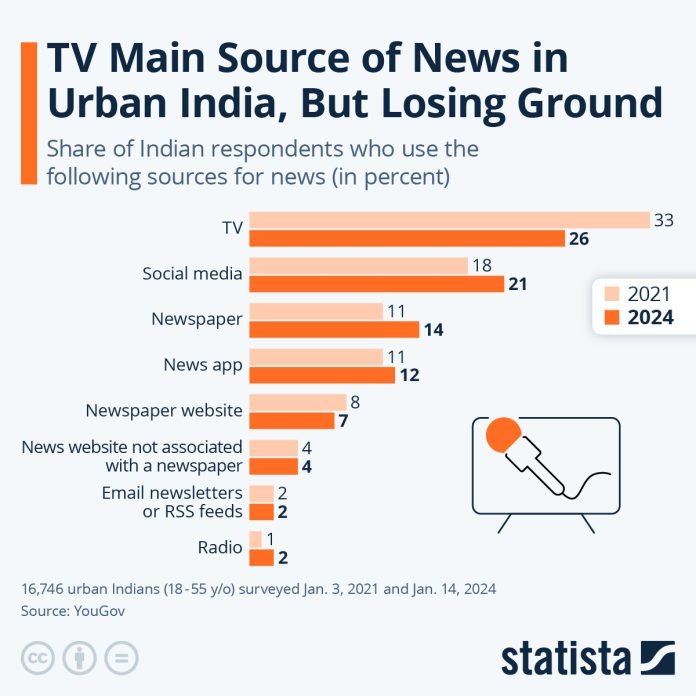

As we see from IppStar’s data and a recent Statista report, print seems to be holding its own if not exactly roaring back to the high levels that preceded the pandemic years. However, according to a recent report by Statista, while new media in print is gaining readership by 3% and TV news, which is still the primary source of news for urban Indians, is losing viewership by 7%, the gains by digital news, including social media by 3% and news apps on tablets and phones by 1% seem to indicate the likely direction of the news consumption.

The Statista report on 21 November 2024 based on a survey by YouGov compares news consumption from 2021 to 2024 based on surveys in each of those years. It says that television is still the primary source of news for urban Indians, but this has shrunk from 33% to 27% of the respondents. Just over one in four respondents said they turned to the TV for news in 2024. This is down from one in three respondents who said the same in 2021.